In this article, we will explore the basic principles of finance, explained specifically for those coming from a non-financial background.

Finance can often feel like a foreign language, filled with jargon and complex concepts.

However, it is important to remember that finance is not limited to financial professionals or experts. In fact, a latest CNBC survey revealed that 70% of Americans are financially stressed.

Everyone, regardless of their background, can benefit from a basic understanding of finance principles. Whether you are a business owner looking to optimize your company’s finances or an individual seeking to make smarter personal financial choices, we will provide you with the necessary insights to get started.

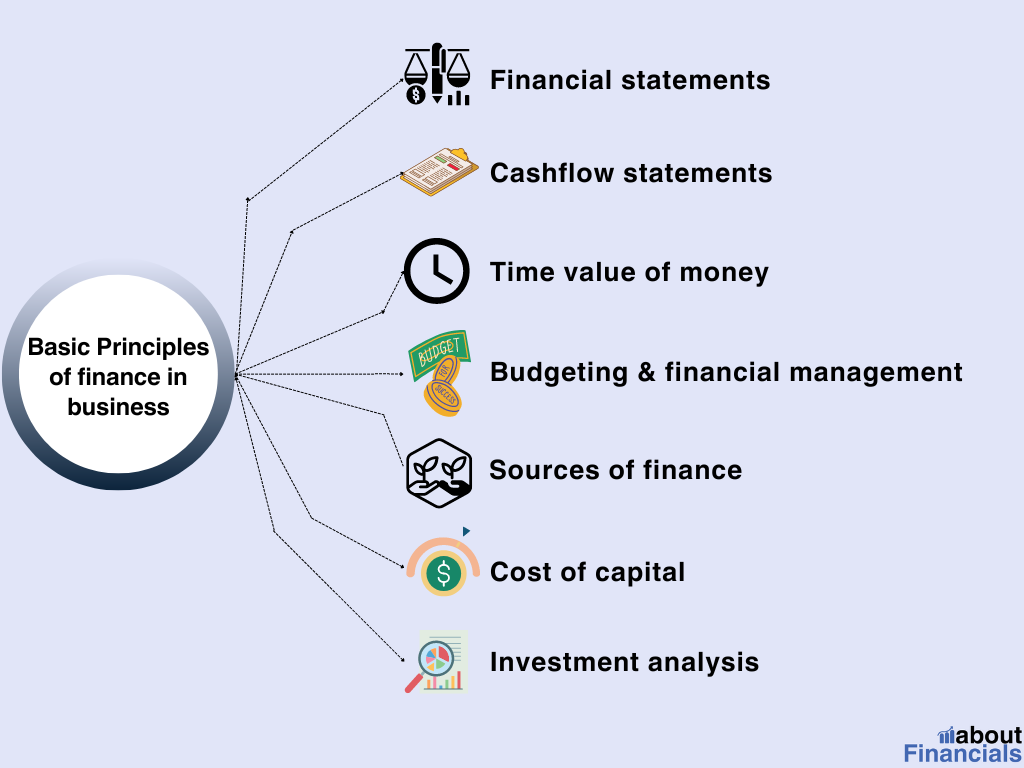

Basic principles of finance for business

Finance is the lifeblood of any business, driving its operations, growth, and profitability.

In simple terms, finance refers to the management of money and assets, and it plays a pivotal role in every aspect of a company’s operations.

Understanding finance concepts is essential for business owners and managers to make informed decisions that positively impact their organization’s financial health.

Let’s explore some key finance concepts that are vital for businesses to grasp.

1. Financial statements

Financial statements serve as a window into a company’s financial performance and position. They provide valuable insights into how well a business is doing and where it stands financially. Let’s take a closer look at three fundamental financial statements:

Balance sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of its assets, liabilities, and shareholders’ equity. Assets represent what a company owns, liabilities represent what it owes, and shareholders’ equity represents the owners’ stake in the business. The balance sheet helps assess the financial health, liquidity, and solvency of a company.

Income Statement

The income statement, also known as the profit and loss statement, showcases a company’s revenues, expenses, and net profit or loss over a specific period. It provides insights into a company’s ability to generate profits and identifies its sources of income and costs. The income statement is crucial for assessing a company’s profitability and understanding its revenue-generating activities.

Cash Flow Statement

The cash flow statement tracks the inflow and outflow of cash within a company during a specific period. It categorizes cash flows into three main activities: operating, investing, and financing. This statement is critical for analyzing a company’s ability to generate and manage cash, ensuring it has enough liquidity to meet its financial obligations.

By comprehending these financial statements, businesses can evaluate their financial performance, identify areas of strength or weakness, and make informed decisions to enhance profitability and sustainability. These statements provide a comprehensive view of a company’s financial health, and the knowledge of how to interpret them empowers business owners and managers to navigate their financial landscape with confidence.

2. Cash flow statements

Operating cash flow

Operating cash flow is the lifeblood of any business. It represents the cash generated or used by a company’s core operations, excluding investment and financing activities. In simpler terms, it’s the cash flow resulting from the day-to-day business activities like sales, collections from customers, and payments to suppliers and employees. Positive operating cash flow signals a healthy and sustainable business model, while negative operating cash flow may indicate underlying operational issues that need attention.

Investing cash flow

While operating cash flow focuses on the core business activities, investing cash flow centers on the company’s capital expenditures and asset acquisitions. It reflects the cash inflows from selling assets and the cash outflows for purchasing new assets, such as property, equipment, or investments. Companies invest in these assets to support future growth, enhance efficiency, or diversify their portfolios. A positive investing cash flow indicates that a company is investing in its future, while negative investing cash flow may suggest divestment or asset liquidation.

Financing cash flow

Financing cash flow deals with the cash flow resulting from changes in a company’s capital structure and funding sources. It includes cash flows from issuing or repurchasing stocks, issuing or retiring debt, and paying dividends to shareholders. This aspect of cash flow provides insights into how a company raises capital and manages its financial obligations. Positive financing cash flow may show the company’s ability to attract investors and access funding, while negative financing cash flow might indicate debt repayment or shareholder distributions.

Free cash flow

Free cash flow is the gold standard of cash flow metrics, representing the cash left over after all operating and capital expenditures are accounted for. It provides a clear picture of a company’s ability to generate surplus cash that can be used for various purposes. Positive free cash flow allows a company to invest in growth opportunities, pay dividends, reduce debt, or accumulate cash reserves. On the other hand, negative free cash flow may necessitate external financing or signal financial constraints.

3. Time value of money

One of the fundamental basic principles of finance is the time value of money. Simply put, the time value of money recognizes that the value of money today is different from its value in the future. This concept is critical for businesses as well as individuals, as it helps us understand the importance of considering the timing of cash flows and the impact of interest rates.

When we talk about the time value of money, two key concepts come into play: present value and future value.

Present value

Present value refers to the current worth of a future sum of money, discounted at an appropriate interest rate. Essentially, it helps us determine the value of receiving a certain amount of money in the future, in today’s terms. Understanding present value allows businesses and individuals to assess the attractiveness of potential investments or evaluate the cost of financing options.

How to calculate present value:

The present value represents the current value of a future sum of money, discounted at a specific interest rate. It helps determine how much a future cash flow is worth in today’s terms. The formula for present value is:

PV = CF / (1 + r)^n

Where:

- PV = Present value

- CF = Cash flow in the future

- r = Interest rate (discount rate)

- n = Number of periods

- ^ = Caret Symbol – the caret symbol (^) is used to denote exponentiation, which represents raising a number to the power of another.

Example: Let’s say you are expecting to receive $1,000 after 3 years, and the discount rate is 5%. To calculate the present value, we can use the formula:

- PV = $1,000 / (1 + 0.05)^3

- PV = $1,000 / (1.05)^3

- PV ≈ $863.84

So, the present value of receiving $1,000 in 3 years, assuming a discount rate of 5%, is approximately $863.84.

Future value

Future value, on the other hand, represents the value of an investment or cash flow at a specific point in the future, given an assumed interest rate. By calculating the future value, businesses can determine the potential growth of their investments over time. It also helps individuals plan for long-term financial goals, such as retirement or purchasing a property.

How to calculate future value:

The future value represents the value of an investment or cash flow at a future point in time, given a specific interest rate. It helps determine the growth or accumulation of an investment over time. The formula for future value is:

FV = PV * (1 + r)^n

Where:

- FV = Future value

- PV = Present value

- r = Interest rate

- n = Number of periods

- ^ = Caret Symbol – the caret symbol (^) is used to denote exponentiation, which represents raising a number to the power of another.

Example: Let’s say you invest $1,000 today in a savings account that earns an annual interest rate of 6% for 5 years. To calculate the future value, we can use the formula:

- FV = $1,000 * (1 + 0.06)^5

- FV = $1,000 * (1.06)^5

- FV ≈ $1,338.23

Therefore, your investment of $1,000, compounding at an annual interest rate of 6% for 5 years, would grow to approximately $1,338.23.

4. Budgeting and financial planning

Budgeting allows businesses to have a clear overview of their financial situation and helps them stay on track towards their objectives. It serves as a financial compass, guiding businesses towards profitability, growth, and sustainability. Here’s why budgeting is crucial for businesses:

Let’s explore the key elements of a business budget:

- Revenue Projections: This includes sales revenue, service fees, and any other sources of income. Expense Categories: Categorizing expenses helps businesses analyze their spending patterns and identify areas for cost optimization.

- Fixed and Variable Costs: It is important to distinguish between fixed costs (e.g., rent, salaries) and variable costs (e.g., raw materials, utilities) when creating a budget.

- Contingency Fund: A budget should also include provisions for unforeseen expenses or emergencies.

5. Sources of financing

When it comes to funding business operations, there are various sources of financing available.

Debt financing

Debt financing involves borrowing funds from external sources, such as banks, financial institutions, or bondholders. This form of financing allows businesses to access capital without diluting ownership.

- Loans: Businesses can obtain loans from banks or other lending institutions to finance their operations.

- Bonds: Companies can issue bonds to raise funds from investors. Bonds are essentially debt instruments where investors lend money to the issuing company for a specific period, earning interest on their investment.

Equity financing

Equity financing involves raising capital by selling ownership stakes in the company.

- Issuing stocks: Companies can raise funds by issuing shares of common or preferred stock to investors.

- Venture capital and angel investors: These investors provide capital in exchange for an ownership stake and often offer expertise and guidance to help the business grow.

Internal sources

Internal sources of financing refer to funds generated from within the business itself.

Retained Earnings: Retained earnings are the accumulated profits that have not been distributed to shareholders as dividends.

Internal sources of financing offer businesses greater flexibility and control over their financial resources.

6. Cost of capital

The cost of capital is a crucial concept in finance that represents the overall cost of financing a company’s operations, projects, or expansion plans.

Weighted average cost of capital (WACC)

The Weighted Average Cost of Capital (WACC) is a financial metric that calculates the average cost of all the different sources of capital a company uses. The formula for WACC is as follows:

WACC = (E/V) * Ke + (D/V) * Kd * (1 – Tc)

Where:

- WACC = Weighted Average Cost of Capital

- E = Market value of equity

- V = Total market value of equity and debt

- Ke = Cost of equity

- D = Market value of debt

- Kd = Cost of debt

- Tc = Corporate tax rate

Calculating the WACC helps businesses determine the minimum rate of return required to cover the cost of capital and satisfy the expectations of investors. A lower WACC indicates a lower cost of capital, which generally makes projects more appealing.

Capital structure decisions

It is crucial for businesses to strike the right balance between debt and equity to optimize their cost of capital and maximize shareholder value.

Key considerations for capital structure decisions include:

- Cost of Debt: The cost of debt refers to the interest rate or cost of borrowing funds.

- Cost of Equity: The cost of equity represents the return expected by shareholders for investing in the company.

- Risk-Return Tradeoff: Capital structure decisions involve striking a balance between risk and return. Higher levels of debt financing may lower the cost of capital but increase financial risk, while more equity financing may result in higher costs but provide a more stable financial structure.

7. Investment analysis

Investment analysis is a critical process that helps businesses evaluate potential investment opportunities and make informed decisions regarding the allocation of resources.

Net Present Value (NPV)

NPV is one of the most important basic principles of finance which measures the profitability of an investment by calculating the present value of expected cash inflows and outflows. A positive NPV indicates a potentially profitable investment, while a negative NPV suggests that the project may not generate sufficient returns.

Internal Rate of Return (IRR)

IRR represents the discount rate at which the present value of cash inflows equals the present value of cash outflows. It measures the rate of return an investment is expected to generate. Comparing the IRR with the required rate of return helps businesses evaluate the attractiveness of the investment.

Profitability Index (PI)

The profitability index calculates the ratio of the present value of cash inflows to the present value of cash outflows. It helps determine the value created per unit of investment. A PI greater than 1 indicates a potentially profitable investment.

Return on Investment (ROI)

ROI measures the profitability of an investment as a percentage of the initial investment. It compares the gains or returns generated from the investment to the cost of the investment. A higher ROI indicates a more favorable investment opportunity.

Payback period

Itrepresents the time it takes for an investment to recover its initial cost. It is calculated by dividing the initial investment by the expected annual cash inflows. A shorter payback period is generally preferred as it indicates a faster return on investment.

B. Basic principles of personal finance

1. Creating a personal budget

Managing your finances effectively starts with creating a personal budget.

A budget serves as your financial GPS, guiding you towards responsible spending, savings, and investments.

It’s a tool that empowers you to take control of your money and make informed financial decisions.

Tracking income and expenses

The first step in creating a budget is to track your income and expenses. Categorize them into essentials (like housing, utilities, and groceries) and discretionary spending (like dining out, entertainment, and vacations).

Using budgeting apps or spreadsheets can be immensely helpful in organizing your financial data. By understanding where your money comes from and where it goes, you can identify spending patterns, detect areas of overspending, and make necessary adjustments.

Allocating funds for savings and investments

After assessing your income and expenses, it’s time to allocate funds for savings and investments. Prioritize building an emergency fund to cover unexpected expenses and create a safety net for challenging times.

A rule of thumb is to have enough savings to cover three to six months’ worth of living expenses.

Once your emergency fund is in place, focus on saving for your financial goals.

Allocate a portion of your income to specific objectives, such as retirement, buying a home, or funding education.

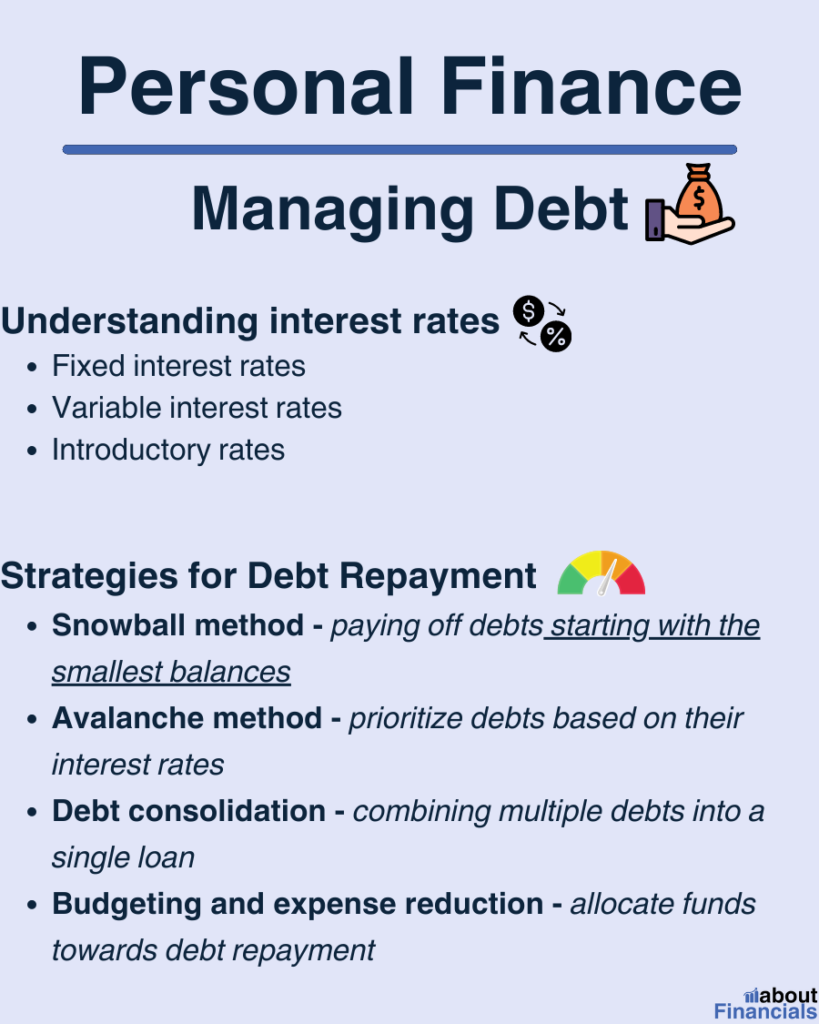

2. Managing debt

Managing debt requires a combination of understanding interest rates and implementing strategies for debt repayment.

Understanding interest rates

Interest rates play a crucial role in debt management. They determine the cost of borrowing and impact the total amount you’ll repay over time. When managing debt, it’s important to understand the different types of interest rates and their implications:

- Fixed interest rates: The rate remains constant throughout the loan term. This provides stability as your monthly payments remain predictable, making it easier to plan your budget.

- Variable interest rates: These fluctuate based on market conditions. While they may start lower than fixed rates, they can increase over time, affecting your monthly payments.

- Introductory rates: Some loans offer introductory rates, which are low or zero interest rates for a specified period. It’s crucial to understand the duration of the introductory period and the subsequent interest rates that will apply afterward.

Strategies for Debt Repayment

When it comes to managing debt, implementing effective repayment strategies is key. Here are some strategies to consider:

- Snowball method: This method involves paying off debts starting with the smallest balances first while making minimum payments on other debts. As you pay off each debt, you roll the payment amount into the next one, creating a snowball effect.

- Avalanche method: In this method, you prioritize debts based on their interest rates. Start by paying off debts with the highest interest rates while making minimum payments on other debts. By targeting high-interest debts, you can minimize the overall interest you’ll pay over time.

- Debt consolidation: Debt consolidation involves combining multiple debts into a single loan or credit line with a lower interest rate. This simplifies repayment and can potentially lower your monthly payments. However, it’s important to carefully consider the terms and conditions of the consolidation option to ensure it’s beneficial in the long run.

- Budgeting and expense reduction: Implementing a budget allows you to allocate funds towards debt repayment. Analyze your spending habits and identify areas where you can reduce expenses to free up additional funds for debt payments. Cut back on unnecessary expenses and redirect those savings towards your debts.

3. Saving and investing

Saving and investing are essential components of a solid financial plan. They provide the foundation for building wealth, achieving financial goals, and securing a stable future. Let’s explore the importance of having an emergency fund and the various investment options available to grow your wealth.

Personal investments

Here are three common investment options ideal for an individual:

Stocks

Stocks represent ownership in a company. Investing in stocks allows you to participate in the company’s growth and potentially earn returns through dividends and capital appreciation. However, stocks are subject to market fluctuations and carry a higher level of risk compared to other investment options.

Bonds

Bonds are debt securities issued by governments, municipalities, or corporations. By purchasing bonds, you lend money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

Mutual funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the investors.

When choosing investment options, consider factors such as your risk tolerance, investment goals, and time horizon. It’s important to conduct thorough research, seek advice from financial professionals if needed, and diversify your investments to manage risk effectively.

4. Understanding credit and credit scores

Credit plays a significant role in our financial lives, influencing our ability to obtain loans, secure favorable interest rates, and even rent an apartment.

Building and maintaining a good credit score

A credit score is a numerical representation of your creditworthiness and financial history. Lenders, landlords, and even potential employers use it to assess your reliability and responsibility in managing debt. Here’s how you can build and maintain a good credit score:

- Establish a credit history: You can do this by opening a credit card or obtaining a small loan. Make timely payments and keep your credit utilization low to demonstrate responsible credit management.

- Pay bills on time: Consistently paying your bills, loan installments, and credit card balances on time is crucial for maintaining a good credit score. Set up automatic payments or use reminders to stay on track.

- Manage credit utilization: Credit utilization refers to the percentage of your available credit that you’re using. Aim to keep your credit utilization below 30% to demonstrate responsible credit management.

- Maintain a mix of credit: Having a mix of different types of credit, such as credit cards, loans, and a mortgage, can positively impact your credit score. It shows that you can manage various types of debt responsibly.

- Regularly monitor your credit report: Reviewing your credit report regularly allows you to identify errors, fraudulent activity, or any negative information that may be impacting your credit score. You can request a free copy of your credit report annually from each of the three major credit bureaus.

5. Retirement planning

Retirement is a phase of life that deserves careful planning to ensure financial security and a comfortable lifestyle. Let’s explore the different types of retirement accounts and strategies for retirement savings that can help you build a nest egg for your golden years.

Types of retirement accounts

- 401(k): A 401(k) is a retirement savings plan offered by many employers. It allows employees to contribute a portion of their pre-tax income to the plan, with the contributions often matched by the employer. The funds in a 401(k) grow tax-deferred until withdrawal, typically during retirement.

- Individual Retirement Account (IRA): An IRA is a personal retirement savings account that individuals can set up on their own.

There are two primary types of IRAs. Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement, as long as certain conditions are met.

Strategies for retirement savings

- Start early: Time is a valuable asset when it comes to retirement savings. The earlier you start saving, the more time your money has to grow through the power of compounding.

- Contribute regularly: Aim to contribute a percentage of your income to your retirement accounts, whether it’s through employer-sponsored plans or personal IRAs.

- Take advantage of employer matches: If your employer offers a 401(k) plan with a matching contribution, make sure to contribute enough to receive the full match. Employer matches provide a valuable opportunity to boost your retirement savings without any additional effort on your part.

- Diversify investments: Allocate your retirement savings across a mix of investment options, such as stocks, bonds, and mutual funds, based on your risk tolerance and time horizon.

- Rebalance your portfolio: Regularly review and rebalance your investment portfolio to ensure it aligns with your retirement goals. As you get closer to retirement, consider gradually shifting towards more conservative investments to protect your savings from market volatility.

- Minimize fees: High fees can eat into your returns over time. Look for low-cost investment options and consider consolidating accounts to simplify management and potentially reduce fees.

6. Pay attention to taxes

Taxes play a significant role in personal finance.

Tax-efficient investing: Consider utilizing tax-advantaged accounts like IRAs or 401(k)s to reduce your taxable income and potentially defer taxes on investment gains.

Deductions and credits: Take advantage of deductions and credits available to you when filing your taxes. Keep track of eligible expenses, such as mortgage interest, educational expenses, and charitable contributions, to potentially reduce your tax liability.

Tax planning: Regularly review your financial situation and consult with a tax professional to optimize your tax strategy. This includes understanding the impact of changes in tax laws, estimating your tax liability, and exploring opportunities for tax optimization.

Final thoughts on basic principles of finance

In conclusion, we have explored the basic principles of finance for both business and personal finance contexts. By understanding these fundamental concepts, individuals from non-financial backgrounds can gain the knowledge and confidence to make informed financial decisions.

To our non-financial audience, I encourage you to apply these principles in your everyday lives. Whether you are managing your personal finances or making financial decisions for your business, understanding the basics of finance empowers you to set goals, allocate resources effectively, and ultimately achieve financial success.

By continuously expanding your financial knowledge, you equip yourself with the tools to adapt to changing circumstances, seize opportunities, and mitigate risks. Financial literacy is an ongoing journey that lays the foundation for long-term financial success and stability.