One of the most powerful tools in a trader’s arsenal is the analysis of candlestick patterns. These patterns, formed by the price movements of an asset over a specific period, provide valuable insights into market sentiment and potential price reversals.

What is the Bearish Abandoned Baby Pattern

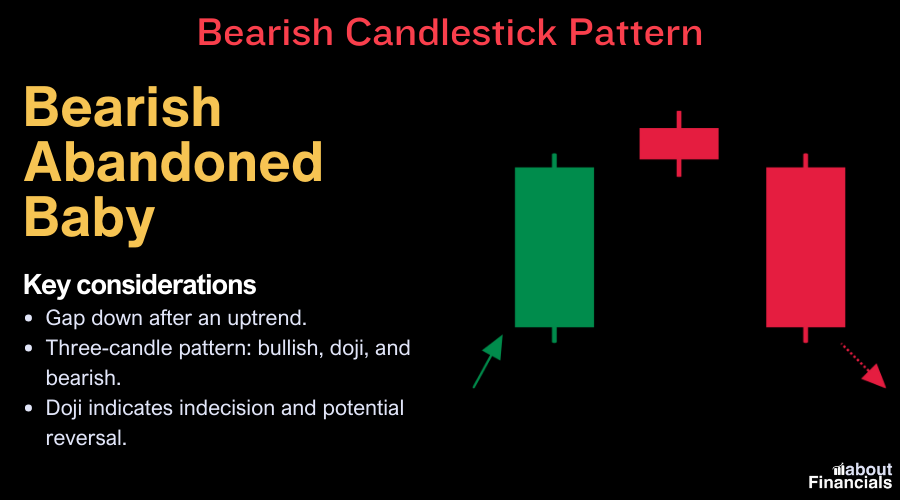

At the heart of candlestick pattern analysis is the concept of the “Bearish Abandoned Baby” pattern. This intriguing pattern is characterized by a sequence of three distinct candles on a price chart. The pattern’s formation consists of two key elements: a gap, a Doji, and another gap. Let’s break down each component and understand how they come together to create the Bearish Abandoned Baby pattern.

Interpreting the Bearish Abandoned Baby – Potential reversal

Understanding the psychology behind the Bearish Abandoned Baby pattern is crucial for grasping its significance as a potential market reversal signal. Let’s explore the interpretation of the pattern and explore why it’s considered a compelling bearish signal.

Bearish sentiment reinforced

The Bearish Abandoned Baby pattern’s formation represents a sudden resurgence of bearish sentiment after a brief period of uncertainty. The first gap showcases a significant downward movement, reflecting the prevailing downtrend’s strength. The subsequent Doji suggests a pause, where traders momentarily hesitate, uncertain about the market’s next direction.

Indecision and reversal clues

The Doji serves as a key transitional element in the pattern. Its appearance indicates a temporary standoff between bulls (buyers) and bears (sellers). Traders are unsure whether the trend will continue or if a reversal is imminent. The second gap, however, resolves this uncertainty by swiftly pushing prices lower, signaling that bears have gained the upper hand.

Confirmation through volume

While the pattern’s components offer valuable visual cues, it’s essential to incorporate trading volume analysis for confirmation. An increase in trading volume during the second gap adds weight to the pattern’s validity. Higher volume indicates stronger conviction among market participants, reinforcing the likelihood of a bearish reversal.

Bearish momentum building

The Bearish Abandoned Baby pattern paints a picture of bearish momentum intensifying. The pattern suggests that sellers are regaining control and driving prices downward with renewed vigor. This change in sentiment can potentially lead to extended downtrends or even trend reversals, making the pattern a compelling signal for traders.

Price targets and stop-loss placement

Traders who spot the Bearish Abandoned Baby pattern can use it as a basis for setting price targets and stop-loss levels. Price targets are often set by measuring the height of the second gap and projecting it downward from the Doji’s low. Stop-loss orders can be placed above the pattern’s high to manage risk in case the pattern’s bearish interpretation is invalidated.

Steps to Identify and Confirm the Bearish Abandoned Baby

Identifying and confirming the Bearish Abandoned Baby pattern on a candlestick chart requires a systematic approach that combines visual analysis with technical indicators. By following these steps, you can enhance your ability to recognize this potent bearish reversal signal and make well-informed trading decisions.

Step 1: Select your chart

Choose the financial instrument you want to analyze and open its candlestick chart. Ensure that you are looking at an appropriate time frame, such as daily or weekly, to capture meaningful price movements.

Step 2: Look for the first gap

Scan the chart for a noticeable gap between the closing price of the previous candle and the opening price of the next candle. This gap should be accompanied by a significant downward movement, indicating strong bearish momentum.

Step 3: Identify the Doji

Locate the Doji candle that follows the first gap. The Doji’s open and close prices should be nearly identical, showcasing a period of indecision and potential market reversal.

Step 4: Spot the second gap

After the Doji, observe the formation of another gap. This gap should be in the opposite direction of the first gap, with the opening price of the third candle significantly lower than the Doji’s closing price.

Step 5: Confirm through volume

Check the trading volume during the formation of the Bearish Abandoned Baby pattern. An increase in volume during the second gap validates the pattern’s authenticity and suggests stronger market conviction.

Step 6: Validate with other indicators

Consider additional technical indicators, such as the RSI, MACD, or trendlines, to confirm the pattern’s validity. Look for alignment between these indicators and the pattern’s narrative.

Step 7: Assess market context

Examine the broader market context, including trend direction, key support/resistance levels, and fundamental catalysts. A Bearish Abandoned Baby pattern near resistance levels or after a prolonged uptrend adds to its reliability.

Step 8: Set price targets and stop-loss

Calculate potential price targets by measuring the height of the second gap and projecting it downward from the Doji’s low. Place stop-loss orders above the pattern’s high to manage risk if the bearish interpretation is invalidated.

Step 9: Practice and verify

Practice identifying the Bearish Abandoned Baby pattern on historical charts to refine your skills. Verify your analysis against actual market outcomes to assess the pattern’s predictive accuracy.

Remember that while the Bearish Abandoned Baby pattern can be a powerful signal, it is not infallible. Consider combining its recognition with other technical and fundamental analyses to make well-rounded trading decisions. Additionally, remain vigilant for false signals or variations of the pattern that might require further scrutiny.

Factors influencing the bearish abandoned baby pattern

While the Bearish Abandoned Baby pattern holds significant potential as a market reversal signal, its reliability is influenced by various factors that traders should consider when incorporating it into their analysis. Let’s explore these factors and understand how market conditions and trading volume play a crucial role in confirming the validity of this pattern.

Market context and trend reversals

The Bearish Abandoned Baby pattern is most potent when it forms at the end of a prolonged uptrend. This context adds weight to the pattern’s bearish implications, as it suggests a potential shift from bullish to bearish sentiment. Additionally, the pattern’s reliability increases when it occurs near key resistance levels, where bulls may face heightened selling pressure.

Volume confirmation

Trading volume acts as a powerful tool for validating the Bearish Abandoned Baby pattern. A substantial increase in volume during the second gap confirms the pattern’s authenticity. Higher volume signals heightened market conviction and underscores the potential for a significant price reversal. Traders should look for volume that supports the pattern’s narrative to enhance its predictive power.

Additional technical indicators

While the Bearish Abandoned Baby pattern holds its own merit, combining it with other technical indicators can provide a more comprehensive view of market conditions. Oscillators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can offer supplementary insights into overbought or oversold conditions, adding depth to your analysis.

Fundamental catalysts

Keep an eye on fundamental catalysts that might align with the pattern’s formation. Economic releases, corporate earnings reports, geopolitical events, or central bank decisions can influence market sentiment and amplify the pattern’s significance. Fundamental analysis can provide a broader context for the pattern’s potential impact on prices.

Pattern variations and confirmation patterns

It’s important to note that while the classic Bearish Abandoned Baby pattern is a powerful reversal signal, variations can occur. These variations may still offer valuable insights, but traders should exercise caution and consider the entire technical and fundamental landscape before making trading decisions. Additionally, confirmatory patterns like bearish engulfing patterns or dark cloud covers can further validate the Bearish Abandoned Baby signal.

Practice and experience

Like any skill in trading, recognizing and interpreting candlestick patterns, including the Bearish Abandoned Baby, improves with practice and experience. Regular chart analysis and pattern identification enhance your ability to distinguish genuine patterns from noise and false signals.

Trading strategies using the bearish abandoned baby pattern

The Bearish Abandoned Baby pattern serves as a powerful tool for traders seeking to capitalize on potential market reversals and profit from bearish trends. By incorporating this pattern into your trading strategy, you can enhance your ability to identify lucrative opportunities and make well-informed decisions. Here are some effective trading strategies that leverage the Bearish Abandoned Baby pattern:

Strategy 1: Short selling

Short selling is a popular strategy that involves selling an asset with the expectation that its price will decline. When you spot a Bearish Abandoned Baby pattern, consider opening a short position. Place a sell order as close to the Doji’s low as possible and set a target based on the projected price decline from the second gap. Use a stop-loss order above the pattern’s high to manage risk.

Strategy 2: Buying put options

Buying put options provides you with the right to sell an asset at a predetermined price (strike price) within a specified timeframe. When the Bearish Abandoned Baby pattern forms, you can purchase put options on the underlying asset. As the price drops following the pattern’s confirmation, the value of your put options may increase, allowing you to profit from the decline.

Strategy 3: Swing trading

Swing traders aim to capture short- to medium-term price movements by entering and exiting positions within a few days to a few weeks. When the Bearish Abandoned Baby pattern emerges, swing traders can take advantage of the impending bearish move. Enter a short position as the pattern confirms, and set a profit target based on technical levels or the pattern’s projected decline.

Strategy 4: Confirmation patterns

Combine the Bearish Abandoned Baby pattern with other bearish confirmation patterns, such as the bearish engulfing pattern or the dark cloud cover. When multiple patterns align, they strengthen the overall bearish signal. Look for confluence between the patterns and consider entering short positions based on their collective confirmation.

Strategy 5: Fundamental analysis alignment

Integrate fundamental analysis into your trading strategy by aligning the Bearish Abandoned Baby pattern with negative news or events that could impact the asset’s value. This combination of technical and fundamental factors enhances the probability of a successful trade.

Strategy 6: Scalping for short-term gains

Scalping involves making rapid, short-term trades to profit from minor price fluctuations. While the Bearish Abandoned Baby pattern is often associated with medium-term trends, skilled scalpers can utilize it to identify short-term selling opportunities within the context of the pattern’s formation.

Strategy 7: Risk management

Regardless of the chosen strategy, always practice proper risk management. Determine the appropriate position size based on your risk tolerance and overall portfolio. Utilize stop-loss orders to protect your capital and avoid exposing yourself to excessive losses.

Bearish Candlestick patterns cheat sheet

Dive into our comprehensive article on Bearish candlestick patterns cheat sheet [free PDF cheat sheet included]. Discover how to recognize and utilize various bearish patterns, including the powerful Bearish Abandoned Baby, to make informed trading decisions.

Bearish Abandoned Baby – FAQs

Difference between bearish abandoned baby and bullish abandoned baby

The main difference lies in their market implications. Bearish Abandoned Baby signals a potential bearish reversal, consisting of a gap down, doji, and gap up. Bullish Abandoned Baby indicates a bullish reversal with a gap up, doji, and gap down, suggesting a shift from bearish to bullish sentiment.

Trading bearish abandoned babies

Trading bearish abandoned babies involves recognizing the pattern’s formation, validating it through volume and technical analysis, then entering short positions. Set price targets based on the pattern’s projected decline and use stop-loss orders for risk management.

Abandoned baby bullish

Abandoned Baby Bullish is a bullish reversal pattern. It comprises a gap down, doji, and gap up, indicating a potential shift from bearish to bullish sentiment in the market.

Rarest candlestick pattern

The “Three River Evening Star” is considered one of the rarest candlestick patterns. It involves a complex arrangement of three candlesticks and signifies a potential trend reversal.

Making money on bearish trades

Profit from bearish trades by short selling, buying put options, or using inverse ETFs. These strategies capitalize on price declines, allowing you to make money as the market moves down.

Day trading in a bear market

Day trading in a bear market can be more challenging due to increased volatility and potential for sharp reversals. Traders need strong risk management, adaptability, and a well-defined strategy to navigate bearish conditions.

Accuracy of abandoned baby candlesticks

Abandoned baby candlesticks can be accurate reversal signals, but like any pattern, they are not foolproof. It’s crucial to confirm them with other indicators and perform comprehensive analysis.

Best timeframe for trading candlesticks

The best timeframe depends on your trading style. Short-term traders might focus on intraday charts, while swing traders may prefer daily or weekly charts for a broader view of price movements.

Predictive power of candlesticks

Candlesticks provide insights into price movements based on past behavior and market psychology. While they don’t predict with certainty, they offer valuable indications of potential trends.

Morning Doji Star vs. Abandoned Baby

Both patterns indicate potential reversals, but the Morning Doji Star involves a doji between two larger candles, suggesting a shift from bearish to bullish. Abandoned Baby focuses on a gap, doji, and gap, signaling a trend reversal in either direction.

Trading in a bear market

Trading in a bear market can be challenging due to increased risk, but opportunities exist. Short selling, hedging, or focusing on defensive sectors are strategies to consider.

Bearish reversal strategies

In a bearish reversal, consider short positions, buying put options, or reducing exposure to vulnerable assets. Implement risk management and stay informed about market conditions.

Final thoughts

Incorporating the Bearish Abandoned Baby pattern into your trading toolkit empowers you to anticipate potential market reversals, adjust your positions accordingly, and navigate changing market dynamics with confidence. Remember that no single trading signal guarantees success, and combining technical analysis with fundamental insights contributes to a well-rounded approach.

By leveraging the power of the Bearish Abandoned Baby pattern and integrating it into a comprehensive trading framework, you are better equipped to navigate the complexities of the financial markets and work toward achieving your trading goals.

We hope this guide has provided valuable insights and tools to enhance your trading knowledge and decision-making abilities. Happy trading!