In the world of banking, understanding the concept of assets and liabilities is crucial for effective financial management.

Banks operate by managing various financial instruments and transactions, and assets and liabilities form the foundation of their balance sheets.

In this section, we will define assets and liabilities in the context of banking and highlight their importance.

Overview

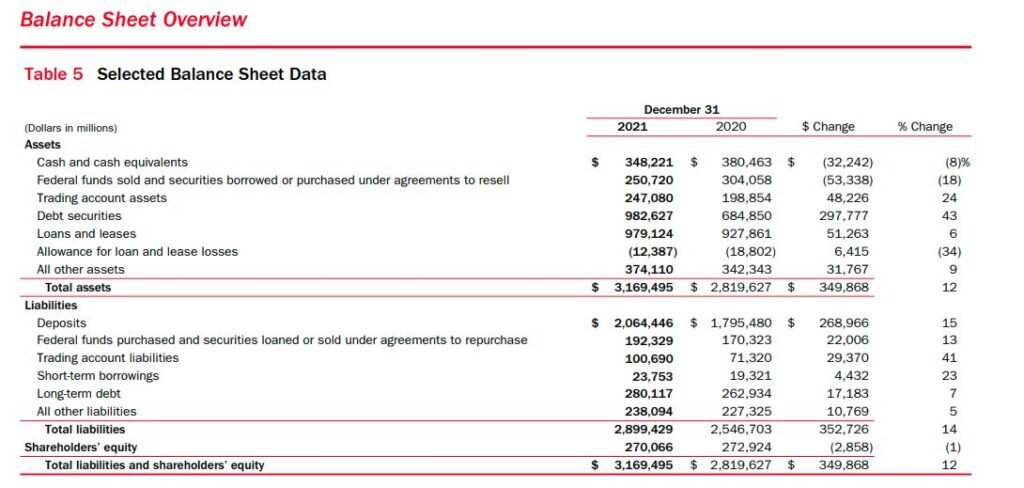

Assets are the resources owned by a bank that have economic value and generate future financial benefits. On the other hand, liabilities represent the obligations and debts owed by the bank to external parties. Together, assets and liabilities provide a comprehensive view of a bank’s financial position and help assess its solvency, liquidity, and overall stability.

Having a clear understanding of assets and liabilities enables banks to make informed decisions regarding capital allocation, risk management, and profitability. Without a further ado, let’s explore the examples of assets and liabilities in banking.

Example of Assets in Banking

Assets play a vital role in the operations and performance of a bank. They represent the resources that a bank utilizes to generate income and provide services to its customers. Here are some examples of assets commonly found in banking:

1. Cash and cash equivalents

This includes physical currency, balances held in checking and savings accounts, and highly liquid investments such as Treasury bills. Cash and cash equivalents ensure that a bank can meet immediate financial obligations and fund day-to-day operations.

2. Loans and advances

Banks extend credit to individuals, businesses, and other entities in the form of loans and advances. These can include mortgages, personal loans, commercial loans, and lines of credit. Loans generate interest income for the bank and are considered as one of the primary revenue-generating assets.

3. Investment securities

Banks often invest in securities such as government bonds, corporate bonds, and equities. These investments can provide additional income through interest, dividends, or capital appreciation. However, they also carry market and credit risks.

4. Property and equipment

Banks own physical assets such as office buildings, branches, ATMs, and computer systems. These assets facilitate banking operations and support the delivery of services to customers.

5. Intangible assets

Intangible assets in banking may include trademarks, brand value, software licenses, and goodwill. These assets are non-physical but can contribute to the bank’s overall value and reputation.

6. Other financial assets

Banks may hold various other financial instruments, such as derivative contracts, securitized assets, and foreign currency holdings. These assets serve specific purposes and may carry different levels of risk.

Each of these assets contributes to the bank’s financial position, income generation, and risk exposure. The composition and management of assets are critical factors in determining a bank’s profitability, liquidity, and overall financial health.

Example of Liabilities in Banking

Liabilities represent the obligations and debts owed by a bank to external parties. They play a significant role in shaping a bank’s funding structure and financial stability. Here are some examples of liabilities commonly found in banking:

1. Deposits from customers

One of the primary sources of funding for banks is customer deposits. These can include demand deposits, savings accounts, certificates of deposit, and other types of accounts. Deposits provide banks with a stable source of funds that can be used for lending and investment activities.

2. Borrowings and debt instruments

Banks may also raise funds by borrowing from other financial institutions, issuing bonds, or utilizing short-term credit facilities. These borrowings serve as additional sources of liquidity for the bank, but they typically come with repayment obligations and interest payments.

3. Bank reserves and interbank liabilities

Banks are required to maintain reserves with central banks to ensure liquidity and fulfill regulatory requirements. These reserves act as a safeguard against unforeseen liquidity needs. Additionally, banks may have interbank liabilities, representing funds borrowed from or lent to other banks.

4. Other liabilities

This category includes various other obligations that a bank may have, such as trade payables, accrued expenses, and provisions for future liabilities. These liabilities are recorded on the bank’s balance sheet and must be managed effectively.

The liabilities of a bank serve as a funding source for its assets and operations. It is essential for banks to maintain an appropriate balance between their assets and liabilities to ensure financial stability, liquidity management, and regulatory compliance.

Relationship between Assets and Liabilities

Assets and liabilities in banking are interconnected and have a significant impact on a bank’s overall financial position and performance. Let’s explore the relationship between assets and liabilities:

Composition and Maturity Management: Banks aim to strike a balance between short-term and long-term assets and liabilities. By matching the maturity profiles, banks can manage liquidity risks and ensure they have sufficient funds to meet their obligations as they become due.

Profitability

The composition of assets and liabilities affects a bank’s profitability. For example, loans and investments generate interest income, while interest paid on deposits and borrowings represents a cost. Banks must optimize the spread between the interest earned and interest paid to enhance profitability.

Risk Management

The types of assets and liabilities held by a bank influence its risk exposure. For instance, loans carry credit risk, while investments in securities carry market risk. By diversifying their asset portfolios and carefully managing liabilities, banks can mitigate risks and maintain financial stability.

Capital Adequacy

Banks are required to maintain a certain level of capital to absorb losses and ensure solvency. The relationship between assets and liabilities determines the bank’s capital adequacy ratio, which reflects its ability to withstand financial shocks and meet regulatory requirements.

Strategic management of assets and liabilities is crucial for banks to optimize their financial performance, maintain liquidity, manage risks effectively, and meet regulatory obligations. By carefully monitoring and adjusting the composition, maturity, and risk profiles, banks can enhance their overall financial position and stability.

Final thoughts

Our goal of this article is to provide essential understanding and relevant examples of assets and liabilities in banking sector. This understanding enables the relevant stakeholders to make informed decisions, comply with regulatory requirements, and build trust and confidence among their depositors and investors.

To read more about examples of assets and liabilities in various industries, please explore below.

Examples of Assets in Cyber Security