The stock market, a bustling financial hub where fortunes are made and lost, serves as the heartbeat of the global economy.

It is a place where individuals and institutions come together to buy and sell shares of publicly traded companies, signaling their confidence or concern in the business world. In this article, we will explore the history of stock markets and the pivotal events that have shaped their existence.

Definition of a stock market

A stock market, also known as a stock exchange or bourse, is a centralized marketplace where buyers and sellers trade stocks (shares) of publicly listed companies. These exchanges provide a platform for companies to raise capital by issuing shares to the public, allowing investors to become partial owners and share in the company’s profits and losses.

Importance of stock markets

Stock markets play a crucial role in the modern global economy, acting as a catalyst for economic growth and development. They facilitate capital formation, enabling companies to raise funds for expansion, research, and innovation.

Origins and early beginnings

The roots of stock markets can be traced back to ancient civilizations, where merchants and traders engaged in informal agreements to pool resources and share profits and losses from joint ventures. These early forms of trading laid the groundwork for the development of more structured stock markets.

First ever stock exchange

The 17th century witnessed a significant milestone in the history of stock markets with the establishment of the Amsterdam Stock Exchange in 1602.

It was formed by the Dutch East India Company, which sought to raise capital for voyages to the East Indies. The exchange allowed investors to buy and sell shares of the company, becoming the world’s first official stock exchange. This pivotal development laid the foundation for future stock markets around the globe.

Early stock market practices

In the early stages, stock markets operated through physical gatherings at coffeehouses or trading floors where brokers and investors would conduct transactions face-to-face.

These open outcry systems involved shouting and hand signals to convey buying and selling orders. Although these methods facilitated trade, they were not without limitations, such as limited trading hours, communication challenges, and slower transaction speeds.

As stock markets began to take shape, they became instrumental in financing ventures like colonial exploration, infrastructure projects, and trade expeditions.

Stock exchanges in Europe

Following the establishment of the Amsterdam Stock Exchange, the idea of formalized stock trading gained traction in other European countries. In 1698, the London Stock Exchange (LSE) was founded, becoming one of the oldest and most prominent stock exchanges globally. Soon after, stock exchanges emerged in Paris (1724) and other major European cities, contributing to the growth of capital markets.

New York stock exchange (NYSE)

As the United States grew in economic significance, the need for a formal stock exchange became evident. In 1792, twenty-four stockbrokers signed the Buttonwood Agreement under a buttonwood tree on Wall Street in New York City, forming what later became the New York Stock Exchange (NYSE). The NYSE quickly became a symbol of American capitalism and a critical player in the nation’s financial development.

First transcontinental railroad

In the mid-19th century, the completion of the First Transcontinental Railroad in the United States was a game-changer for stock markets. The railroad connected the East and West coasts, significantly improving transportation and communication. This led to increased trade, easier access to information, and a boost in stock market activity as investors sought to capitalize on the nation’s expanding economy.

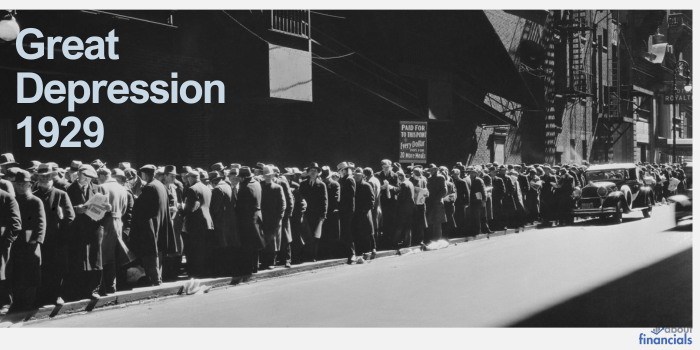

As stock markets evolved, they faced periods of turbulence and volatility. The 1929 Wall Street Crash and subsequent Great Depression demonstrated the vulnerability of financial markets to speculative bubbles and the consequences of inadequate regulations.

Stock market events

1929: Great Depression

One of the most infamous events in stock market history occurred on October 29, 1929. On this fateful day, the U.S. stock market experienced a catastrophic collapse, leading to widespread panic selling and the loss of billions of dollars in stock value. The crash marked the beginning of the Great Depression, a severe worldwide economic downturn that lasted for much of the 1930s.

1934: Formation of the U.S. Securities and Exchange Commission (SEC)

In response to the market crash and concerns over investor protection, the U.S. government established the Securities and Exchange Commission (SEC) in 1934. The SEC is a regulatory agency tasked with overseeing securities markets and enforcing federal securities laws. Its creation brought greater transparency, accountability, and stability to the U.S. stock market.

1971: The Launch of NASDAQ and Its Influence on Stock Trading

In 1971, the National Association of Securities Dealers (NASD) created the NASDAQ (National Association of Securities Dealers Automated Quotations) as the world’s first electronic stock market. Unlike traditional exchanges, NASDAQ operated as a computerized system, facilitating faster and more efficient trading. It became a hub for technology-related companies, fostering innovation in the financial industry.

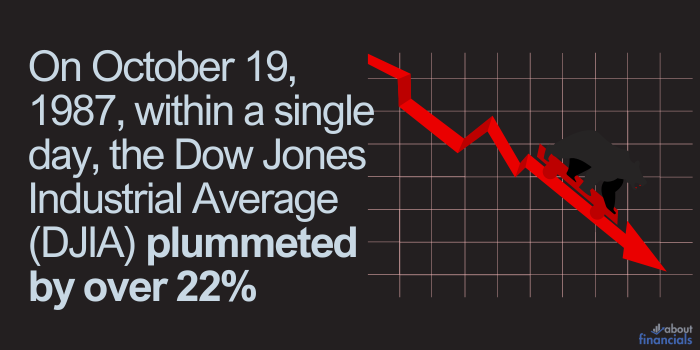

1987: Black Monday and its global repercussions

On October 19, 1987, stock markets around the world experienced a sudden and severe crash known as “Black Monday.” Within a single day, the Dow Jones Industrial Average (DJIA) plummeted by over 22%, marking one of the largest one-day percentage losses in history. The crash raised concerns about market stability and prompted regulatory efforts to prevent similar events in the future.

1999-2000: The Dot-com bubble and its burst

In the late 1990s, a speculative frenzy gripped the technology sector, leading to the dot-com bubble. Investors eagerly poured money into internet-related companies with high valuations but limited profits. The bubble burst in early 2000, resulting in the collapse of many overvalued tech companies, significant market losses, and an economic downturn.

2007-2008: The global financial crisis and its aftermath

The 2007-2008 financial crisis was triggered by a subprime mortgage crisis in the United States, which escalated into a global banking crisis and a severe economic recession. Major financial institutions faced insolvency, and stock markets experienced sharp declines, leading governments to implement extensive bailouts and stimulus packages to stabilize the economy.

2020: The COVID-19 pandemic and its impact on stock markets

In early 2020, the outbreak of the COVID-19 pandemic sent shockwaves through global stock markets. Fear and uncertainty led to massive sell-offs, resulting in record market volatility. Governments and central banks implemented unprecedented measures to support economies, stabilizing markets and fostering recovery.

Evolution of stock market practices

Open outcry to electronic trading

The evolution of stock market practices witnessed a significant shift from traditional open outcry systems to electronic trading platforms. Open outcry involved traders physically gathering on the trading floor, shouting and using hand signals to execute transactions. However, this method had limitations, including limited trading hours, the potential for miscommunication, and slower order execution.

Algorithmic trading

Advancements in technology revolutionized stock market operations. Electronic trading platforms emerged, enabling investors to place orders electronically, which improved trade efficiency and accessibility. Additionally, algorithmic trading, driven by complex computer algorithms, automated the execution of large volumes of trades, providing speed and precision beyond human capabilities.

Rise of online platforms

The advent of the internet brought forth a new era of stock market participation for individual investors. Online brokerage platforms allowed people to buy and sell stocks from the comfort of their homes using computers or mobile devices. This democratization of investing empowered millions to access financial markets, making investing more inclusive and widespread.

New innovations like mobile trading apps, robo-advisors, and blockchain-based securities are further transforming the landscape of stock markets and reshaping the way people invest.

Stock market movers in history

Throughout history, several influential individuals have left a lasting mark on the stock market with their astute insights and successful investment strategies. Some of these famous investors include:

Warren Buffett

Known as the “Oracle of Omaha,” Warren Buffett is one of the most successful investors of all time. His value investing approach and long-term perspective have earned him tremendous success and a revered status in the investment community.

George Soros

George Soros is a hedge fund manager and philanthropist known for his bold bets and ability to profit from significant market movements. He gained fame for successfully shorting the British pound in 1992, earning him the title of “The Man Who Broke the Bank of England.”

Peter Lynch

As the former manager of Fidelity’s Magellan Fund, Peter Lynch achieved remarkable returns for his investors. He emphasized the importance of thorough research and investing in companies with growth potential and solid fundamentals.

Economists have also played a vital role in shaping stock market theories and understanding market behavior. Some notable economists include:

Milton Friedman

An influential economist and Nobel laureate, Milton Friedman’s work focused on the role of money supply and its impact on economic growth and inflation. His ideas have influenced monetary policies and investment strategies.

John Maynard Keynes

Keynesian economics, developed by John Maynard Keynes, emphasized the importance of government intervention during economic downturns. His ideas have had a significant influence on economic policies and strategies during times of crisis.

Eugene Fama

Eugene Fama is a Nobel laureate renowned for his work on efficient market theory, which posits that stock prices always reflect all available information. His research has influenced modern portfolio theory and investment practices.

Stock markets in various regions

Stock markets have not been limited to a single geographic location but have flourished in different regions worldwide. As economies grew and international trade expanded, countries established their stock exchanges to facilitate capital raising and investment opportunities. Some notable global stock exchanges include:

- Tokyo Stock Exchange (TSE): Founded in 1878, the TSE is one of the world’s largest stock exchanges and plays a crucial role in the Asian financial landscape.

- Hong Kong Stock Exchange (HKEX): Established in 1891, the HKEX has become a prominent hub for companies seeking to tap into the lucrative Chinese market.

- Frankfurt Stock Exchange (FSE): Dating back to the 9th century, the FSE is one of the oldest stock exchanges and holds significance as a key financial center in Europe.

- Shanghai Stock Exchange (SSE): Founded in 1990, the SSE has gained prominence as China’s leading stock exchange, reflecting the country’s economic growth.

Stock markets across the world are increasingly interconnected due to globalization and advancements in technology. Global economic events, such as recessions, geopolitical tensions, and monetary policy changes, can have far-reaching effects on stock markets. A significant event in one region can trigger a ripple effect, impacting stock prices and investor sentiment worldwide.

Investors now closely monitor economic indicators, political developments, and trade relations on a global scale to make informed investment decisions. The interconnected nature of stock markets emphasizes the importance of diversification and risk management in investment portfolios.

Stock market indexes

Stock market indices are numerical representations of the overall performance of a select group of stocks within a specific stock market or sector. Each index is calculated using a formula that considers the combined market capitalizations or price movements of the constituent stocks. It provides investors and analysts with a quick snapshot of how the stocks in that index are performing relative to a base period or other relevant metrics.

Notable stock market indexes include:

Dow Jones Industrial Average (DJIA)

One of the oldest and most widely recognized indexes, the DJIA tracks 30 large, publicly traded companies in the United States. It represents a diverse range of industries and is often considered a barometer of the broader U.S. stock market.

Standard & Poor’s 500 Index (S&P 500)

The S&P 500 is a broader index that includes 500 large-cap U.S. companies. It is widely regarded as a representation of the overall health of the U.S. economy and is frequently used as a benchmark for investors.

NASDAQ Composite Index

The NASDAQ Composite Index reflects the performance of all the companies listed on the NASDAQ exchange. It primarily includes technology, biotechnology, and internet-related companies.

Beyond the United States, various countries and regions have their own major stock market indexes:

FTSE 100 (Financial Times Stock Exchange)

The FTSE 100 is the main index of the London Stock Exchange, consisting of the 100 largest companies listed in the UK by market capitalization.

Nikkei 225

Japan’s premier stock market index, the Nikkei 225, tracks the performance of 225 blue-chip companies listed on the Tokyo Stock Exchange.

DAX (Deutscher Aktienindex)

The DAX represents the 30 largest and most liquid companies on the Frankfurt Stock Exchange in Germany.

Lessons from history for investors

Throughout history, stock markets have experienced periods of exuberance and sharp declines, often driven by speculative bubbles and subsequent crashes. Learning from these events can provide valuable lessons for investors:

Avoiding herd mentality

During market bubbles, the fear of missing out (FOMO) can lead to irrational investment decisions based on the herd mentality. Investors should focus on sound research and due diligence rather than blindly following the crowd.

Long-term perspective

Market crashes are an inherent part of the stock market’s cyclical nature. Investors who adopt a long-term perspective and stay committed to their investment goals are better equipped to weather short-term volatility.

Diversification

Diversifying investments across various asset classes and industries can reduce risk exposure. A well-diversified portfolio is more resilient during market downturns.

History of Stock Market – FAQs

When was the stock market invented?

The concept of stock markets dates back to ancient times, where informal trading of shares existed in various forms. However, the world’s first official stock exchange was established in Amsterdam in 1602 with the founding of the Amsterdam Stock Exchange.

When did the US stock market start?

The US stock market began with the formation of the New York Stock Exchange (NYSE) in 1792. On Wall Street in New York City, 24 stockbrokers signed the Buttonwood Agreement, creating the foundation for the world-renowned NYSE.

What is the world’s first stock market?

The world’s first official stock market is considered to be the Amsterdam Stock Exchange, founded in 1602. It was established by the Dutch East India Company, allowing investors to buy and sell shares of the company.

How did the stock market work before the Internet?

Before the Internet, stock markets operated through physical trading floors or trading posts where brokers and traders would conduct transactions face-to-face. The open outcry method involved shouting and hand signals to communicate buy and sell orders.

What was the first stock sold?

The first recorded stock issued and sold was by the Dutch East India Company when it offered shares to the public in 1602. These shares allowed investors to participate in the company’s trading ventures to the East Indies.

When did the stock market first hit $1,000?

The Dow Jones Industrial Average (DJIA), one of the leading US market indexes, first surpassed the milestone of 1,000 points in November 1972.

Who owns the stock market?

The stock market is not owned by any single entity. Instead, it consists of numerous publicly-traded companies, financial institutions, and individual investors who buy and sell stocks.

Who controls the stock market?

Stock markets are regulated and overseen by governmental regulatory bodies. In the United States, the Securities and Exchange Commission (SEC) plays a critical role in overseeing securities markets and enforcing federal securities laws.

Who created the stock market?

The stock market, as we know it today, evolved over centuries and was not created by a single individual. Its development was influenced by numerous historical events, financial innovations, and the collaboration of various merchants, traders, and institutions.

Final thoughts

Throughout the years, stock markets have endured moments of exuberance and despair, from the 1929 Wall Street Crash and the Great Depression to the dot-com bubble and the 2007-2008 Global Financial Crisis. These events have left lasting impressions on investors, regulators, and policymakers, shaping the financial landscape we know today.

In the midst of uncertainty and opportunity, the stock market remains a dynamic force, reflecting the hopes and aspirations of millions of investors seeking to build a better financial future. As we continue to evolve alongside the markets, let us embrace the lessons of history, learn from the past, and march forward with the knowledge that the journey of the stock market is as unpredictable as it is full of promise.