While the idea of creating your own cryptocurrency in just 15 minutes may sound enticing, it is important to understand that the actual process is more involved and time-consuming.

The development of a cryptocurrency requires careful planning, meticulous implementation, and thorough testing to ensure its functionality, security, and compliance.

However, we are here to provide you with a comprehensive guide that will walk you through each step of the process. Enabling you to navigate the complexities and make informed decisions to bring your cryptocurrency dream to fruition.

So, let’s explore the necessary steps and considerations that will pave the way towards creating your very own cryptocurrency.

1. Benefits of creating your own cryptocurrency

By crafting your digital currency, you have the freedom to define its purpose and tailor it to your specific needs. Additionally, the potential for innovation is limitless. You can introduce unique features, functionalities, and even integrate it with existing systems or platforms.

Blockchain technology lies at the heart of cryptocurrencies, serving as the backbone that enables their secure and transparent operation.

But what exactly is blockchain, and how does it contribute to the world of digital finance?

2. Easiest explanation of blockchain

Blockchain technology is like a digital ledger that keeps a record of transactions.

Imagine a shared spreadsheet that is duplicated across multiple computers, and each computer has a copy of the same spreadsheet. When a new transaction occurs, everyone updates their copy of the spreadsheet simultaneously.

For example, let’s say you and your friends are sharing a digital notebook to keep track of how much money each of you owes. Whenever someone lends or borrows money, they write it down in the notebook. The special thing is that everyone has a copy of the notebook, and whenever a new entry is added, it is automatically updated in everyone’s notebook. This way, everyone has the same information, and no one can cheat or change the records without everyone else noticing.

This is how blockchain works, a decentralized network of computers maintains a shared ledger, and whenever a new transaction happens, it gets added to the ledger, which is then distributed to all the computers in the network. This creates a secure and transparent system where everyone can trust the recorded transactions without needing a central authority.

Blockchain technology removes the need for intermediaries, such as banks or payment processors, by allowing participants to transact directly with one another. It ensures security through cryptography, making it extremely difficult for malicious actors to tamper with the data. The decentralized nature of blockchain eliminates the single point of failure, making it resistant to censorship and providing a level playing field for all participants.

3. Key concepts of blockchain

Decentralization

Decentralization lies at the core of blockchain technology. Instead of relying on a central authority or intermediary, blockchain networks distribute the responsibility and power among multiple participants. This democratized approach fosters transparency, trust, and autonomy.

Consensus mechanisms

These are the mechanisms by which participants in a blockchain network agree on the validity of transactions and reach consensus. They ensure that all nodes within the network maintain a synchronized and accurate ledger.

Popular consensus mechanisms include Proof of Work (PoW), where participants compete to solve complex mathematical problems to validate transactions, and Proof of Stake (PoS), where participants “stake” their own cryptocurrency as collateral to verify transactions.

Proof of Work (PoW)

Imagine a competition where participants have to solve a challenging math problem. The first participant to solve it gets a reward. The difficulty of the problem is set in a way that it takes a considerable amount of time and computational power to solve. This concept is similar to PoW in blockchain. Miners compete to solve complex mathematical puzzles, and the first one to solve it earns the right to add the next block to the blockchain and receive a reward in the form of cryptocurrency.

Proof of Stake (PoS)

In a Proof of Stake system, instead of miners competing to solve puzzles, validators are chosen to create new blocks based on the amount of cryptocurrency they hold and “stake” in the network. It’s like a voting system where the more stake (currency) a person has, the more likely they are to be chosen to validate transactions and create new blocks. Validators are selected randomly, but the probability of selection is proportional to their stake. Validators are rewarded with transaction fees or newly minted cryptocurrency for their participation in maintaining the network’s security and consensus.

Smart contracts

Smart contracts are self-executing contracts with predefined rules and conditions encoded into the blockchain. These contracts automatically execute and enforce agreements once the specified conditions are met. They enable the creation of decentralized applications (DApps) and facilitate the automation of various processes, from financial transactions to supply chain management.

It’s similar to a regular contract, but instead of relying on intermediaries like lawyers or banks to enforce the agreement, the execution is done automatically using computer code on a blockchain.

Immutable ledger

This is the characteristic of a blockchain where once a transaction is recorded and added to the chain, it cannot be altered or tampered with. The immutability of the blockchain ensures transparency, security, and trust in the recorded transactions.

4. Preparing for the creation process

Creating your own cryptocurrency requires careful preparation and consideration.

Before diving into the technical aspects, it’s essential to lay a solid foundation by defining the purpose and goals of your cryptocurrency, selecting the appropriate blockchain platform, and weighing the options between existing platforms and creating your own blockchain.

Define the purpose and goals of your cryptocurrency

To start, take a moment to reflect on the purpose and goals you envision for your cryptocurrency.

Are you aiming to revolutionize a specific industry, provide a means of exchange, or offer unique functionalities?

Clearly defining your objectives will guide you throughout the creation process and help you make informed decisions that align with your vision.

Choose a blockchain platform for your cryptocurrency creation

Next, it’s time to choose the right blockchain platform to bring your cryptocurrency to life. There are several established platforms available, each with its own set of features and strengths.

Consider factors such as scalability, community support, programming languages, and available tools and frameworks.

Prominent platforms like Ethereum, Binance Smart Chain, and Polkadot offer a robust ecosystem and a wide range of development resources.

Considerations for selecting between existing platforms or creating your own blockchain

Now comes the crucial decision: should you utilize an existing blockchain platform or create your own from scratch?

This choice depends on several factors, including your project’s requirements, desired level of control, and the resources at your disposal.

Opting for an existing platform offers a head start by leveraging its infrastructure, community, and existing tools. It can save time and effort while providing a tested and secure environment.

However, it may also come with limitations or constraints that might not align perfectly with your specific needs.

On the other hand, creating your own blockchain allows for unparalleled customization and control. It offers the opportunity to shape the architecture, consensus mechanism, and functionalities to precisely match your requirements. However, it requires a deeper understanding of blockchain technology and entails more significant development efforts.

5. Creating your cryptocurrency

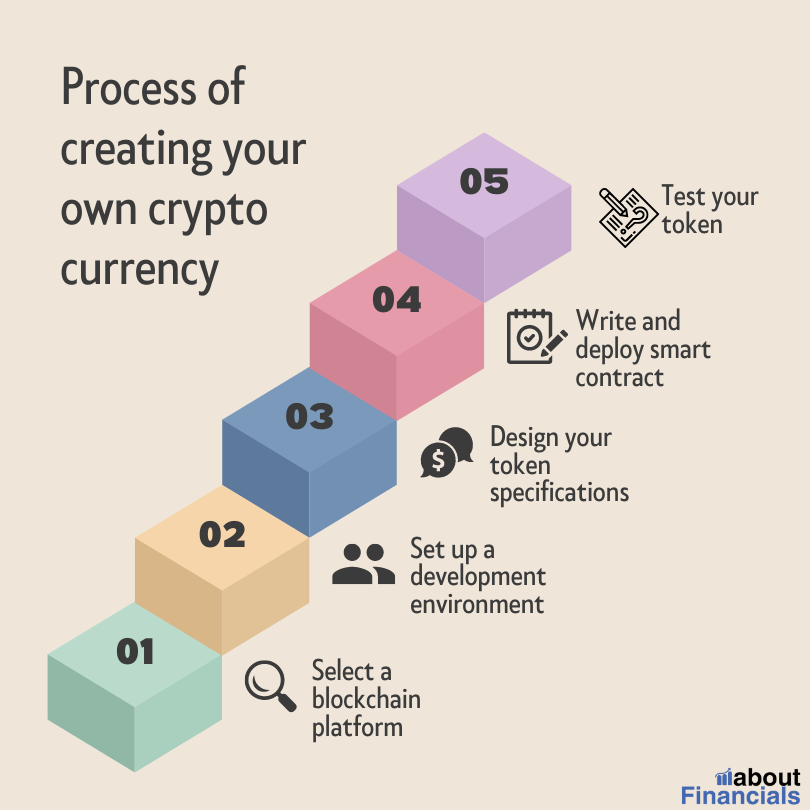

Now that you have prepared the groundwork, it’s time to dive into the exciting process of creating your own cryptocurrency. Whether you choose an existing blockchain platform or decide to forge your own path, this step-by-step guide will help you bring your vision to life.

Step-by-step guide for existing blockchain platforms

Step 1: Select a blockchain platform

The first step is to choose the blockchain platform that will serve as the foundation for your cryptocurrency.

Platforms like Ethereum have a robust ecosystem, while Binance Smart Chain offers lower transaction fees. Assessing these options will ensure that you make an informed decision and set the right foundation for your cryptocurrency.

Remember to keep your project’s goals and long-term vision in mind when selecting a platform. This will help ensure compatibility and scalability as your cryptocurrency evolves.

Once you have chosen your preferred blockchain platform, it’s time to move on to the next step in creating your cryptocurrency.

Step 2: Set up a development environment

To develop your cryptocurrency on the chosen blockchain platform, you’ll need to set up a suitable development environment.

Tools like Truffle and Remix provide the necessary frameworks, compilers, and testing utilities to streamline the development process.

Now it’s time to delve into designing your token specifications.

Step 3: Design your token specifications

Designing your token specifications is a crucial step in creating your cryptocurrency. Determine essential parameters such as the token supply, name, symbol, and decimal places. These specifications will shape the identity and functionality of your cryptocurrency.

Step 4: Write a smart contract for your token

A smart contract acts as the backbone of your cryptocurrency, defining its behavior and governing its transactions. Utilizing programming languages like Solidity, write a smart contract that includes functionalities such as token transfer, balance tracking, and potential additional features unique to your cryptocurrency.

Step 5: Compile and deploy your smart contract

Compile your smart contract code into bytecode, ensuring its correctness and functionality. Once compiled, deploy the smart contract onto the blockchain platform of your choice. This process will make your cryptocurrency operational and accessible to users.

This process establishes the foundation for transactions and interactions involving your token, enabling its circulation and utilization within the blockchain ecosystem.

Step 6: Interact with your token on the blockchain

Interact with your cryptocurrency on the blockchain to test its functionality and ensure that it operates as intended. Perform test transactions, check balances, and verify that your token behaves as expected. This testing phase allows you to identify and resolve any potential issues or bugs before launching your cryptocurrency to a broader audience.

During this testing phase, it’s essential to simulate different scenarios and user interactions to identify and address any potential bugs or issues. By conducting thorough testing, you can fine-tune your cryptocurrency’s functionality, enhancing its reliability and user satisfaction.

By compiling and deploying your smart contract, you officially introduce your cryptocurrency to the blockchain network. Interacting with your token through test transactions ensures its seamless functionality and reliability. These steps pave the way for a successful launch and a positive user experience.

Step-by-step guide for creating your own blockchain

Creating your own blockchain is an ambitious endeavor that grants you unparalleled control and customization. To embark on this journey, follow this step-by-step guide that will assist you in creating a unique blockchain tailored to your specific needs.

Step 1: Define the consensus mechanism

Define the consensus mechanism that best aligns with your goals and requirements. Popular options include Proof of Work (PoW), which relies on computational puzzles, and Proof of Stake (PoS), which relies on participants’ stake in the network. Each mechanism has its advantages and considerations, so choose wisely.

Advantages of Proof of Work (PoW)

- Security: PoW has proven to be a highly secure consensus mechanism. Its computational requirements make it difficult for malicious actors to manipulate the blockchain.

- Decentralization: PoW encourages a decentralized network since multiple miners participate in the process of validating transactions and creating new blocks.

- Established and tested: PoW has been the underlying mechanism for cryptocurrencies like Bitcoin, which has demonstrated its reliability and resilience over time.

Disadvantages of Proof of Work (PoW)

- Energy consumption: PoW requires substantial computational power, leading to high energy consumption. Critics argue that it is environmentally unsustainable.

- Centralization of mining power: As mining becomes more specialized and resource-intensive, there is a risk of centralization, where a few powerful mining entities control a significant portion of the network.

- Scalability challenges: PoW can face scalability issues as the number of transactions increases, resulting in longer confirmation times and higher fees.

Advantages of Proof of Stake (PoS):

- Energy efficiency: PoS requires significantly less energy compared to PoW since it doesn’t rely on extensive computational work.

- Decentralization incentives: PoS promotes decentralization by allowing validators based on the amount of cryptocurrency they hold, encouraging wider participation.

- Scalability potential: PoS has the potential to scale better than PoW since block creation isn’t resource-intensive, enabling faster transaction processing.

Disadvantages of Proof of Stake (PoS):

- Potential centralization based on wealth: Critics argue that PoS may lead to centralization in the hands of wealthy individuals or entities who possess a significant stake in the network.

- Security concerns: Some argue that PoS may be more vulnerable to attacks, as an attacker with a large stake could have the incentive to compromise the network.

- Limited participation for small holders: PoS may require users to lock up their cryptocurrency as collateral to become validators, which can make participation difficult for smaller holders.

Step 2: Design the architecture and infrastructure for your blockchain

The architecture and infrastructure of your blockchain serve as the backbone of its functionality and performance. Carefully consider the various components and their interconnections to create a robust and scalable blockchain.

Start by designing the network structure, which includes determining the number and type of nodes that will participate in the blockchain. Decide whether your blockchain will be public, private, or a combination of both, and consider the level of decentralization you wish to achieve.

Next, design the data structure that will store the transactions and other relevant information. Consider the efficiency, security, and scalability of the data structure to ensure optimal performance.

Additionally, consider the necessary infrastructure to support your blockchain. This may include selecting the hardware and software components required to run and maintain the network effectively. Evaluate factors such as computational power, storage capacity, and network connectivity to ensure a reliable and efficient infrastructure.

Step 3: Create a genesis block and initialize the blockchain

To bring your blockchain to life, you need to create a genesis block and initialize the network. The genesis block is the foundational block of your blockchain and sets the initial parameters for the entire network. It contains important information such as the timestamp, initial configuration, and any initial transactions or allocations.

Creating the genesis block involves carefully defining and specifying these parameters. Consider factors such as the initial distribution of tokens, the network’s initial state, and any specific rules or conditions you want to set. With the genesis block in place, you lay the groundwork for the subsequent blocks and transactions that will follow.

Step 4: Implement the token creation and distribution logic

Now that your blockchain is initialized, it’s time to focus on implementing the logic for token creation and distribution. This step involves defining the rules and mechanisms that govern how new tokens are minted and how they are distributed among participants.

Consider factors such as the total supply of tokens, any inflation or deflation mechanisms, and the allocation strategy. You may choose to distribute tokens through a public sale, an airdrop, or a combination of methods. Design the token creation and distribution logic in a way that aligns with your project’s goals and ensures fairness and efficiency within the ecosystem.

Step 5: Launch and test your blockchain network

With the foundational elements in place, it’s time to launch your blockchain network and put it to the test. Launching involves deploying the network infrastructure, connecting nodes, and ensuring that all components work harmoniously together.

Once the network is up and running, thorough testing becomes crucial. Conduct comprehensive tests to verify the functionality, security, and performance of your blockchain. Simulate different scenarios, transactions, and interactions to identify and address any potential vulnerabilities or inefficiencies. By conducting rigorous testing, you can refine and optimize your blockchain network for a seamless user experience.

6. Security and compliance considerations

Importance of security

Security is paramount when it comes to cryptocurrencies and blockchain networks. As the creator of your own cryptocurrency, it is crucial to prioritize the security of your digital assets and the integrity of your blockchain network. With the increasing popularity of cryptocurrencies, the risk of cyber threats and attacks also rises.

Best practices for securing your cryptocurrency and network

Implementing best practices for security is vital to ensure the robustness of your cryptocurrency and protect it from potential vulnerabilities. Here are some essential measures you should consider:

- Utilize robust cryptographic algorithms to secure transactions, user data, and the integrity of your blockchain network.

- Implement multi-factor authentication mechanisms to add an extra layer of security, ensuring that only authorized individuals can access sensitive components of your cryptocurrency network.

- Conduct regular security audits and code reviews to identify and fix any vulnerabilities or weaknesses in your smart contracts, ensuring the reliability of your cryptocurrency.

- Establish secure key management practices to safeguard private keys and prevent unauthorized access to wallets and funds.

- Continuously monitor your network for any unusual activity, and have a robust incident response plan in place to address and mitigate security breaches effectively.

In addition to security, it is essential to consider the regulatory compliance and legal aspects of your cryptocurrency.

Regulatory compliance and legal considerations

As the creator of a cryptocurrency, you must navigate the regulatory and legal landscape to ensure compliance with applicable laws and regulations. Compliance not only fosters trust among users and investors but also minimizes the risk of legal complications in the future.

Research and understand the regulatory requirements and obligations specific to your jurisdiction.

Consider factors such as anti-money laundering (AML) and know-your-customer (KYC) regulations, tax obligations, and any licensing or registration requirements.

Engaging legal professionals with expertise in blockchain and cryptocurrency can provide valuable guidance in navigating these complexities.

7. Promoting and growing your cryptocurrency

Developing a marketing and branding strategy

To propel your cryptocurrency forward, it’s crucial to develop a comprehensive marketing and branding strategy.

This strategy will help you effectively communicate your unique value proposition and attract a wider audience. Moreover, it will contribute to establishing your cryptocurrency as a trusted and reputable player in the market.

Furthermore, craft a compelling brand message that highlights the key benefits of your cryptocurrency and differentiates it from competitors. Consistency in your branding across various channels and touchpoints is essential to create a strong and recognizable brand presence.

Building a community and engaging with potential users

Building an engaged and loyal community is vital for the long-term growth of your cryptocurrency.

A thriving community not only provides support and advocacy but also serves as an invaluable source of feedback and ideas. To build and nurture your community effectively, consider the following strategies:

- Utilize popular social media platforms like Twitter, Telegram, and Reddit to connect with your target audience. Actively participate in relevant discussions, share valuable content, and respond to inquiries and feedback promptly. Additionally, encourage community members to share their experiences and spread the word about your cryptocurrency.

- Organize virtual or in-person events and webinars to educate potential users about the benefits and applications of your cryptocurrency. These platforms provide opportunities for direct engagement, networking, and knowledge sharing.

- Establish an online forum or discussion board where community members can interact, share ideas, and seek assistance. This fosters a sense of belonging and encourages collaboration within the community.

Listing your cryptocurrency on exchanges

Listing your cryptocurrency on reputable exchanges is crucial to expand its reach and provide a platform for users to buy, sell, and trade. However, the process of listing can vary among exchanges and may involve certain requirements and fees. Here are some steps to consider:

- Conduct thorough research to identify exchanges that align with your cryptocurrency’s target market and goals.

- Each exchange will have specific listing requirements that need to be met. These may include legal and regulatory compliance, documentation, and technical integration.

- Reach out to the exchange’s listing team to initiate the listing process.

- Once your cryptocurrency is listed, make sure to market the listing within your community and through various marketing channels.

8. How to list a crypto coin to an exchange

Just for the sake of a general understanding, below are some key steps involved in listing a crypto currency in an exchange. It’s important to note that the listing process and requirements may vary, and the exchange reserves the right to make decisions based on their evaluation criteria. It’s recommended to refer to exchange’s official website or reach out to their team for the most up-to-date and detailed information on listing a coin on their platform.

- Meet the Requirements: Ensure your coin meets exchange’s listing requirements, including legal compliance, security, and project quality.

- Create an Account: Register an account on exchange and complete the necessary verification processes.

- Prepare Documentation: Gather all required documents, such as legal and compliance-related information, team details, project whitepaper, and any other documentation requested by the exchange.

- Submit application: Fill out the application form and provide accurate and detailed information about your project, team, token economics, and any other relevant details.

- Pay the listing fee: Exchange charges a listing fee, which varies depending on the type of listing.

- Due diligence and review: Exchange will conduct its due diligence and review process, including evaluating the project’s feasibility, technology, team, and compliance with regulatory requirements.

- Negotiate and sign agreement: If your project meets exchange’s criteria, you may need to negotiate terms and sign a listing agreement with the exchange.

- Integration and testing: Collaborate with exchange’s technical team to integrate your coin’s wallet, trading pairs, and other necessary components into exchange’s platform. Test the integration thoroughly.

- Launch and trading: Once the integration and testing are completed successfully, exchange will schedule the official listing date for your coin. It will be available for trading on exchange’s platform, and users can start trading your coin.

Final thoughts

The notion of how to create your own cryptocurrency in 15 minutes may be unrealistic.

Our aim is to provide you with the knowledge and guidance necessary to navigate the intricate process involved in bringing your cryptocurrency idea to life.

By following the step-by-step approach and considering important factors such as blockchain platforms, consensus mechanisms, security measures, and compliance, you can embark on a fulfilling journey towards creating your unique digital asset.

With determination, perseverance, and the understanding that creating a cryptocurrency is a comprehensive undertaking, you can turn your dream into a tangible reality in the ever-evolving world of cryptocurrencies.