Financial statements provide a clear picture of a company’s financial health. They show whether the company is profitable and how much profit it makes.

Most people feel intimidated by financial statements. That’s why so many of us have no idea how to interpret them.

You may be confused by the endless stream of jargon, acronyms, and terms found in financial reports, you’re not alone. We’ll clear up all the confusion with the basics of financial accounting.

For many, financial statements are a mystery. You may be trying to learn about them but need to know where to begin. You don’t have to spend much time learning about accounting theory. You’ll just need to know the basics to develop a sound understanding of financial statements. It will help you make informed investment decisions and know the business’s financial performance.

Why do we need to know the basics of financial statements?

All businesses rely on financial statements to make decisions. As a result, any business owner needs to understand these statements thoroughly and how they fit into a company’s overall business strategy. Financial statements help companies evaluate their performance and decide whether they should raise capital, sell assets, invest in new products, or reduce debt. They’re also critical tools lenders and investors use to gauge the strength of a company’s finances.

Accounting principles

Accounting principles are the rules that govern how a company records its financial transactions and accounts for them.

Accounting principles tell how to record all transactions and events in a business. These transactions and events include sales, purchases, cash received, cash paid, expenses, accounts payable, accounts receivable, assets, liabilities, investments, dividends, taxes, depreciation, etc.

How to Understand Financial Statements of a Company

Financial statements are the bedrock of every business. They’re important document that provides essential information about how the company is performing and what steps it needs to take to improve its finances.

Financial statements include a balance sheet and a statement of income.

The balance sheet lists all the assets and liabilities of the company.

The income statement shows how much the company made during the year.

Moreover, the StatementStatement of changes in equity shows how the company’s shareholders benefited.

Finally, the Statement of cash flows breaks down how much cash the company has on hand and how much it owes.

Components of balance sheet

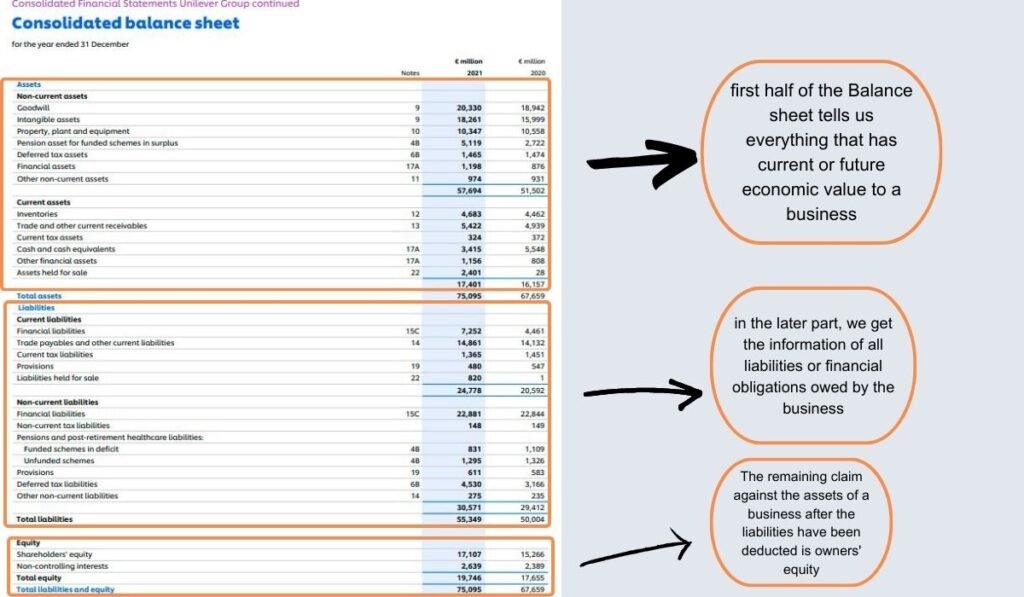

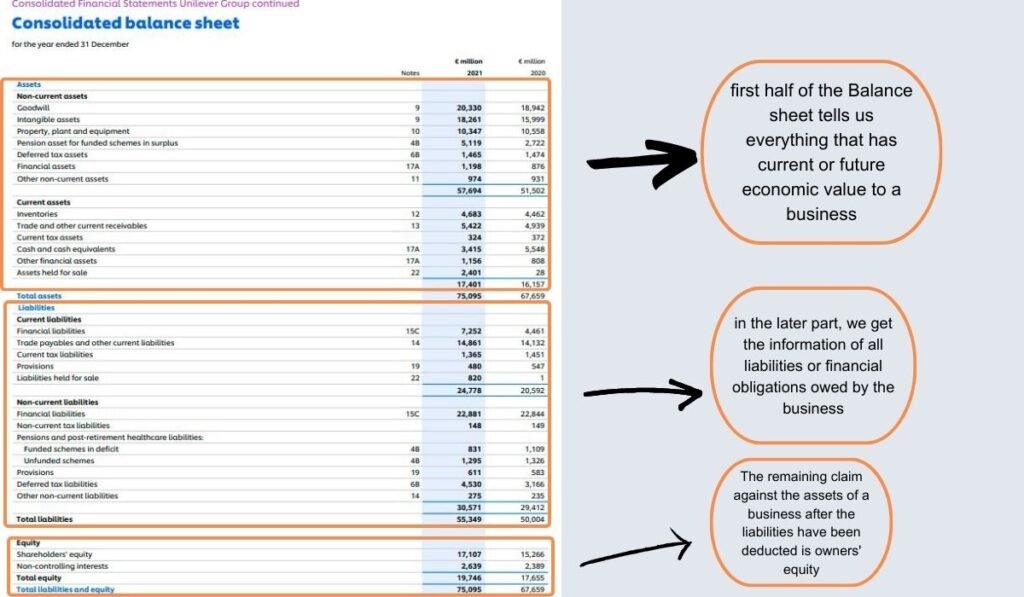

The above balance sheet released by Unilever for the financial year ended on December 2021.

Assets

An asset is something you have. You could say the asset is a property. It could be a building, a car, equipment, a piece of machinery, a patent, or even a copyright. Any item you own gives you control over it.

Liabilities

Liability refers to an obligation to pay financial consideration by a business. Another way to look at liabilities is the outflow of economic benefits by a business.

Equity

Equity is a financial contribution by the owner in exchange for the company’s assets or services. The term “equity” is used to describe the financial rights and obligations that are associated with an ownership interest.

Equity is a term that describes the amount of money left over after paying off all liabilities. Equity is often considered the residual or surplus capital in a company’s assets.

Understand the difference between a Balance Sheet and Income Statement

Balance sheet (also known as StatementStatement of financial position)

Balance sheet, income statement, and cash flow statements are all part of financial statements that reveal the financial health of an organization. Each of these three statements provides different information about the same company.

The balance sheet is a summary of the financial position of the company. It gives us a snapshot of the company’s current state, with all of its assets and liabilities. While the balance sheet is static and not very useful when making decisions about a company, it’s still essential. We can’t predict future earnings and income based on the balance sheet alone, but we can see the firm’s current status.

The balance sheet shows all the assets and liabilities on an entity’s books at the end of a specified accounting period.

The primary objective of a balance sheet is to reveal information about a company’s financial situation and position at a particular point in time. A balance sheet reports on two essential items: (a) assets and (b) liabilities and equity.

Assets include everything the company owns, while liabilities represent debts owed by the company. Equity represents the difference between assets and liabilities. While a balance sheet may look intimidating, most business owners understand its basic structure.

A Balance Sheet is used to show a company’s financial condition at a specific point in time. For example, if you’re running a small business, you’ll need to record all your assets, liabilities, equity, and total stockholders’ equity on the balance sheet to track your company’s current financial position.

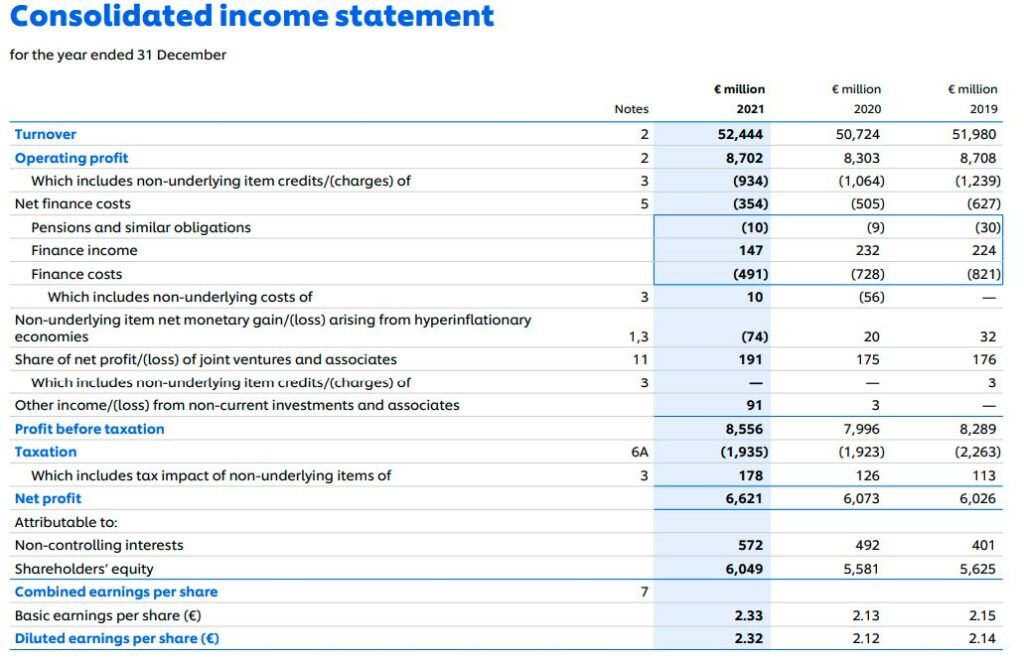

Income Statement (also known as Statement of financial performance)

An income statement reports revenues and expenses for a particular period. An income statement shows us how a company has performed during a specific period.

Most commonly used by investors to determine if a business is successful or whether or not to invest in it, the income statement will show you what the company has made and what they have spent.

Another common name used for the Income statement is the Profit and loss statement or P&L statement.

The primary purpose of an income statement is to show the profit or loss of a business over a period of time. It shows whether or not the business is profitable and gives the investor a good idea of how much money he or she can expect to receive back from the company.

Understand the Basic Financial Ratios

Ratios are measures of financial performance or health.

A ratio is simply an amount divided by another amount.

One ratio is the relationship between a company’s profit margin and its sales; another is the relationship between a company’s expenses and its sales.

These ratios are often used as measures of a company’s financial performance. The ratios help predict a company’s future success because they indicate how efficiently it is producing revenues and spending money.

The financial ratio is the simplest and most straightforward method to evaluate any business.

There are various ratios from where you get the indicators that show whether a company is profitable.

For example, below are some of the most critical ratios and their interpretation for your quick reference.

Asset turnover and Return on assets ratios tell us that if a company is generating profits and showing an increase in its assets over time, the company is financially healthy. If the asset turnover ratio and Return on assets are low, the company is not financially healthy and should be avoided as a buyer.

Know how to read a balance sheet, income statement, and cash flow statement to see if a company is financially healthy.

Financial statements are an excellent way to determine if a company is financially healthy.

If a company has $10,000 in cash, $1,000 in inventory, and no debt, you can bet it’s in good shape.

However, if a company operates with negative cash flow, it loses money.

Cash flow is the amount of money coming in minus the money going out.

To see if your business is making money or losing money, look at the balance sheet. It shows where you are in terms of money and assets.

An income statement shows where you are in terms of income and expenses.

And a cash flow statement shows where you are in terms of what money is coming into the business versus what is going out of it.

Understand the accounting treatment of revenue, income, equity, and expense.

Revenue is all the money you earn due to your company’s efforts. Income is defined as all the money received minus expenses. Expenses are what you spend to run your business, like payroll and rent.

Understand the basics of GAAP and IFRS so you can interpret financial statements

IFRS (International Financial Reporting Standards) is a set of rules and standards for reporting and measuring the financial results of businesses located outside the United States. GAAP (Generally Accepted Accounting Principles) is used by most American businesses to report their financial results. It’s important to understand that while GAAP and IFRS may seem similar, they are actually two very different accounting systems.

How does depreciation affect a business?

Depreciation is a loss on assets used to produce a company’s services. These losses should be subtracted from profits to avoid double counting.

Conclusion

Financial reporting standards should be more straightforward for readers not from a finance background. Financial statements are not meant to be over complicated. If financial statements are not harmonized with the general understanding of the public, they will end up confusing the readers, and they’ll be less likely to pay attention.