What if you get a raise of $10,000 or maybe $20,000 in your annual salary?

Or maybe you want to drive more leads to your financial consultancy business.

The best way to achieve such goals is to invest in your education. You get a chance to enhance your financial knowledge base. Also, a prestigious certification adds value to the resume and amplifies the authenticity of professional skills.

Top financial certifications in the world

We have listed down all the top financial qualifications in the world. So that you can opt for the best certification as per your current role and your growth plans.

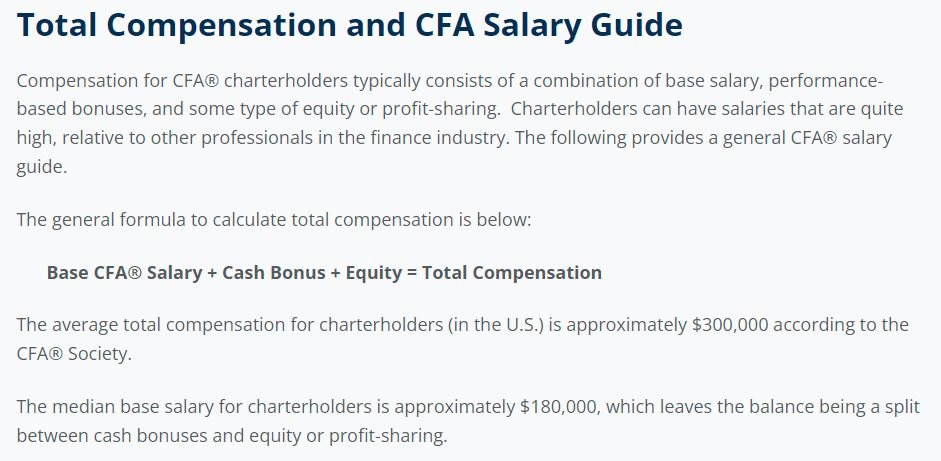

1. Chartered Financial Analyst (CFA)

Chartered Financial Analyst CFA is the highest-ranked in the financial industry. CFA is considered to be a golden ticket to excel in the financial industry. There are only 160,000 CFA charter holders in the world working in 164 markets.

CFA Institute was formed in 1947 to promote financial education and work on the welfare of the profession. In 1962, the CFA institute first officially conducted exams and was awarded the CFA designation.

The top employers that actively hire CFAs include JP Morgan Chase, Bank of America, PWC, Ernst Young, Morgan Stanley, Merrill Lynch, and HSBC.

Following are the core exam topics to be tested in all three CFA exams.

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial Statement Analysis

- Corporate Issuers

- Equity Investments

- Fixed Income

- Derivatives

Benefits of doing CFA

- Considering the employment prospects, CFA is way more cost-effective than MBA. The average cost of doing an MBA is $60,000 and $100,000 from top business schools. It only takes from $2,500 to $10,000 to complete the CFA exams, depending upon the number of attempts taken.

- You become a member of 160,000 elite finance professionals worldwide. Most of these members are working in decision-making positions.

- CFA chartered is globally recognized and considered one of the most prestigious designations in the world.

Why CFA may not be suitable for you

Despite all the good things about CFA, it is still considered one of the toughest financial qualifications. You need to show a strong commitment to completing the CFA. The average passing rate is still under 50%. It shows that every second student doesn’t pass the exam on each attempt. Unlike MBA, the CFA program is quite flexible, so you need to have robust self-discipline in place to keep yourself motivated.

2. Chartered Alternative Investment Analyst (CAIA)

CAIA is another great financial certification that focuses on hedge funds, and ethics. Real assets, private equity, and risk management. The certification is administered by the CAIA Association. This is a global professional body fostering financial awareness among investors.

What is an alternative investment?

An alternative investment is an investment in real assets such as real estate, venture capital, art, antiques, commodities, etc. It is different from traditional investments which include stocks, cash, and bonds.

Benefits of doing CAIA

The cost of doing CAIA is very affordable. Additionally, it only takes 12 months to 18 months to complete the qualification.

Why CAIA may not be suitable for you

CAIA is very specific and only focuses on Alternative investments. It’s good to have in addition to other professional qualifications. However, it cannot beat the broader understanding if you opt to do CFA or MBA.

3. Financial Risk Management (FRM)

In 1996 two risk managers used to meet in New York to discuss their profession. At that time there was no qualification existed completely focusing on Financial Risk Management. Though CFA was there for a long time, still risk managers felt the need for the specialized body to serve the professional more diligently.

Finally, in 1997, FRM was born and started conducting exams, and awarding the designation of FRM.

To start the FRM, you need to register yourself with GARP. After that, you need to select your desired intake and enroll for exams.

You need to pass two levels/ exams to complete the FRM. GARP conducts FRM exams in August and November. Generally, a student with a good understanding of finance can complete FRM within one year.

To earn the title of FRM, you need to have two years of relevant work experience.

Difference between CFA and FRM

Many people think that CFA and FRM are almost similar.

This is not the case. The primary responsibility of FRM qualifies is to identify, quantify and mitigate risks. On the other hand, CFA evaluates securities and performs the financial analysis.

FRM is quite focused on risk management topics. CFA provides a more in-depth understanding of corporate finance and portfolio management.

The difficulty level of CFA is way more than FRM.

CFA takes at least 2 years to complete. However, you can pass FRM within a year easily.

Why you should pursue FRM

- You become a member of elite risk management experts of 150,000 worldwide.

- The exam structure is very flexible. It can be pursued with an existing job

- Very cost-effective, as the total cost of doing FRM is under $2,500.

- The average salary of an FRM is more than $ 100,000.

Why FRM is not suitable for you

- Considering the difficulty level, it may be difficult for someone not good at numerical and applying complex risk models.

- The job horizon is very limited. Most of the FRMs work as risk managers. The high-end positions (e.g., CFO) require more diverse qualifications such as CPA.

4. Certified Financial Planner (CFP)

Certified Financial Planner is a prestigious designation that is accredited by the National Commission of Certifying Agencies US.

CFP is best for those who want to pursue their careers as financial advisors. The average salary of a CFP is $67,613 per year. The experienced CFPs earn more than $113k in a year.

To CFP qualification revolves around 4 Es. It includes Education, Exam, Experience, and Ethics.

To maintain the quality and highest level of professionalism, the CFP board ensures that the candidate should have suitable qualifications before taking exams of CFP.

Education requirements before taking the CFP exam

You need to have a Bachelor’s degree (in any discipline) or complete coursework on financial planning prescribed by the CFP board.

Exam

Once you fulfill the required education requirements, you are eligible to take CFP exams, conducted in one divided into two sections of 3 hours. There are 85 questions in each section. The following topics are covered in the CFP exam:

- Investment planning.

- Tax planning and estate planning.

- Risk management and insurance planning.

- Advanced financial planning.

The exams are conducted three times a year, March, July, and November.

Experience

You need to have 6,000 hours of relevant work experience in the financial planning process to achieve the designation of CFP after your name. Alternatively, you need to complete 4,000 hours of apprenticeship experience as prescribed by the CFP body.

Ethics

The final step is to commit to acting as a fiduciary with the CFP board. Meaning you show the highest level of professional ethics and act in the best interest of the client while providing financial advice.

Cost

The standard exam registration fee is $925. You can avail of the early bird discount of $100 until 6 weeks before the registration deadline. You can also register for exams before 2 weeks of the registration deadline by paying $1,025.

5. Chartered Financial Consultant (ChFC)

If you want to study financial advisory in detail then ChFC could be a better option than CFP.

Everyone needs financial planning for taxation, retirement, wealth management, and optimizing insurance, you name it.

Chartered Financial Consultant designation offers you to enhance your financial planning skills. It not only helps in securing lucrative financial advisory jobs but also helps you to become a chartered consultant and start your own consultancy business.

More than 40,000 ChFC designation holders are working as financial advisors in the US. And the best thing about ChFC is it addresses financial scenarios happening in the real world.

Currently, ChFC is offered by the American College of Financial Services which has been offering ChFC since 1982.

How to become a Chartered Financial Consultant?

- You need to have at least three years of relevant full-time work experience in the last five years.

- You need to complete 9 courses. After each course, there is an exam. In total, you need to pass 9 exams one after each course.

- The total estimated cost of courses and exams is $5,670.

- You don’t need to attend college, the ChFC designation is 100% online.

6. Chartered Insurance Counselor (CIC)

In the insurance sector, the designation of Certified Insurance Counselor (CIC) is getting traction with its niche-focused expertise. The designation is ideal for agency owners, brokers, insurance personnel, and agents.

If you are an insurance professional or full-time teaching insurance-related courses, CIC would bring a more in-depth understanding of the subject matter. And eventually, you can stand out from the crowd. Insurance professionals with at least two years of full-time insurance or risk management experience

You have the option to study on campus or learn online.

How to become Chartered Insurance Counselor?

There are no prerequisites to start CIC. However, it’s recommended to have at least two years of full-time insurance-related work experience to have a deep understanding of the curriculum.

You need to pass 5 exams after completing 5 courses. After each course, you need to pass the relevant exam. Following are the courses to be taught in CIC:

- Agency Management

- Commercial Casualty

- Commercial Multiline

- Commercial Property

- Personal Lines

- Life & Health

- Insurance Company Operations

7. Certified Management Accountant (CMA)

CMA has been a very prestigious finance certification for more than 50 years. The certification enables professionals to think beyond the “numbers”.

Solid financial rationales always help companies to make meaningful decisions.

CMA designation has been awarded to more than 100,000 professionals worldwide. The passing rate is 50%, which is good compared to CFA or FRM.

CMA tests 12 competencies in its exams broadly covering the integral aspects of the operations. It helps to reach the top level in the organization. Because being a CMA, you are not only considered a “Financial expert”, instead you develop a strong understanding of financial reporting, planning, budgeting, cost management, internal controls, etc.

How to become a Certified Management Accountant?

- You need to have a bachelor’s degree or professional accounting certification to start pursuing CMA.

- Additionally, you need to have 2 years of full-time relevant work experience.

- Finally, you need to complete two exams covering 12 topics in 3 years. Generally, it takes 12 to 18 months to pass both exams.

- The CMA certification is very cost-effective. You need to pay $250 to register with CMA. After that $415 is charged for each exam ($830 in total for both exams).

Which financial certification is hardest?

Chartered Financial Analyst (CFA) is the hardest qualification. According to CFA Institute, it takes four years on average to complete the CFA exams. There are three tough exams in which very tricky topics are tested (e.g., quantitative methods, equity investments, alternative investments, and derivatives.) Another thing that makes CFA difficult is the mandatory prerequisites to apply for exams. You need to have a bachelor’s degree or relevant work experience of 4,000 hours.

Which certification is best for CFO?

Certified Public Accountant (CPA) is the most relevant certification for CFO. It gives you a solid understanding of the financial reporting standards which is the primary responsibility of the CFO. The percentage of CFOs with CPA qualifications has increased from 25% to 45% since 2003. Moreover, Certified Management Accountant (CMA) is the second-best qualification for CFO.

Which online certification is best for finance?

Chartered Financial Consultant (ChFC) is one of the prestigious certifications for finance that offers 100% online study. You need to complete 9 courses and it takes $5,670 to complete ChFC.

Does the CFO need CFA?

CFA is not required to become a CFO. As mentioned earlier, CFA doesn’t give in-depth knowledge of reporting standards. CFA is more relevant to portfolio managers, risk managers, and financial analysts.

Is CFA better than ACA?

If you want to excel in the financial sector, then CFA will be your golden ticket. Otherwise, ACA gives you more freedom to work in different domains of finance.

CFA revolves around financial analysis, whereas, ACA focuses on accounting. However, there are many areas where both overlap. Therefore, you need to go through the curriculum of both to determine what suits you better.

Easiest financial certifications?

Considering the course content and entering requirements ChFC, CMA, and CFP are considered the easiest financial certifications. As compared to CFA where you need to have a bachelor’s degree or 4,000 hours of work experience. To complete CMA, you only need to possess 2 years of work experience. And it takes 12 to 18 months to pass the CMA exams. On the flip side, it takes 4 years to complete the CFA program.