In the world of entrepreneurship, understanding the complexities of “Types of Startup Funding Rounds” is very important. Securing the right funding at each stage can be the make-or-break factor for startups aiming to turn their visions into reality. From seed funding to Series A, B, and beyond, these funding rounds play a pivotal role in shaping a startup’s growth journey.

Startup funding is the lifeline that fuels the ambitions of entrepreneurs. It involves raising capital from various sources to support the business’s growth, development, and operations.

These funds are instrumental in covering costs such as product development, marketing, hiring talent, expanding infrastructure, and entering new markets.

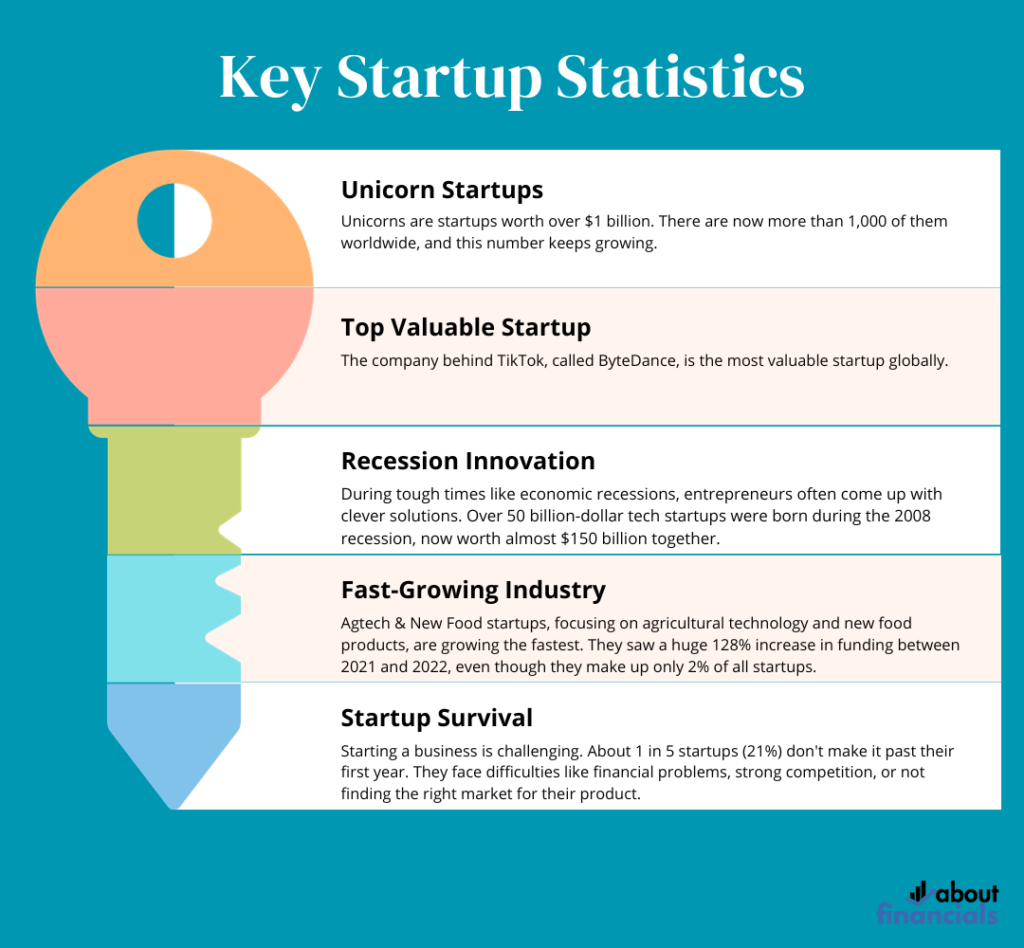

Types of startup funding rounds – a brief overview

Startup funding doesn’t happen all at once. Instead, it’s a journey marked by distinct stages, each with its own purpose and criteria. These stages are often referred to as funding rounds. As a startup progresses through these rounds, it demonstrates increasing viability, proof of concept, and potential for growth. The main stages of startup funding rounds include:

- Seed Funding: The initial injection of capital to get a startup off the ground. Seed funding is typically acquired from angel investors, venture capitalists, friends, family, or even through crowdfunding platforms.

- Series A Funding: This stage comes after a startup has validated its concept and is ready for more substantial funding to scale its operations. Venture capital firms are prominent players in Series A funding.

- Series B Funding: At this point, startups have likely achieved significant milestones and are seeking funds for further expansion, product development, and market penetration.

- Series C and Beyond: As startups continue to mature, later-stage funding rounds like Series C, D, and beyond involve larger investments to solidify market dominance and reach profitability.

- Strategic Partnerships and Acquisitions: Beyond traditional funding, startups may also seek strategic partnerships or even consider acquisition as ways to secure funding and resources.

- Bootstrapping and Self-Funding: Some startups opt to fund themselves, known as bootstrapping, which involves using personal savings or early revenue to fuel growth.

1. Seed Funding

Seed funding is like planting a seed in fertile ground; it’s the initial injection of capital that helps a startup take its first steps towards growth. This funding round is all about turning an innovative idea into a viable product or service. Seed funding serves as the foundation upon which the entire startup journey is built.

Sources of seed funding

Startups seeking seed funding have a variety of sources to tap into. These include:

- Angel Investors: High-net-worth individuals who invest their personal funds in early-stage startups in exchange for equity.

- Friends and Family: Close acquaintances who believe in the founder’s vision and provide financial support.

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow startups to pitch their ideas to a wide audience, collecting small contributions that add up to meaningful seed capital.

Seed funding is typically secured by startups that are in the ideation or prototype stage. These startups might have a compelling concept, a minimal viable product (MVP), and a clear vision of how their product or service will address a specific market need.

Pros of seed funding

- Early Validation: Seed funding validates the startup’s concept and attracts more substantial investment in later rounds.

- Control and Equity: Founders often retain more control and ownership at this stage.

- Networking: Interactions with investors provide valuable insights, mentorship, and connections.

Cons of seed funding

- Limited Funding: Seed rounds provide a relatively small amount of capital compared to later stages.

- Risk: Investors take a chance on unproven concepts, which can be risky.

- Dilution: Equity is given in exchange for funding, potentially diluting the founder’s ownership.

Seed funding is the starting point for many startups, allowing them to lay the groundwork for their journey. It’s a critical step that facilitates product development, market research, and early traction. As startups gain momentum, they can move on to Series A funding to secure larger investments and pursue further growth.

2. Series A Funding

Series A funding marks a pivotal moment in a startup’s evolution. This funding round comes into play once a startup has progressed beyond the initial stages of product development and has gained some traction in the market. Series A funding is often sought to propel the startup to the next level of growth and expansion.

Venture capital (VC) firms are central players in Series A funding. These firms invest in startups with high growth potential in exchange for equity ownership. VC firms bring more than just capital to the table; they provide expertise, industry connections, and guidance to help startups navigate challenges and capitalize on opportunities.

Requirements to qualify for Series A funding

For startups to secure Series A funding, they need to demonstrate:

- Traction: A track record of growing customer adoption, revenue, or user engagement that proves the startup’s concept is resonating in the market.

- Market Opportunity: A clear understanding of the target market, its size, and the startup’s unique value proposition within that market.

- Product Maturity: A refined product or service that addresses a genuine pain point and has the potential for scalability.

Series A funding rounds typically involve larger sums of money compared to seed funding. The funding can range from several million to tens of millions of dollars, depending on the startup’s industry, growth potential, and market dynamics. Startups use Series A funds to:

- Expand their team

- Scale marketing and sales efforts

- Enhance product development

- Enter new markets or regions

- Strengthen infrastructure and operations

Series A funding acts as a catalyst for growth, allowing startups to accelerate their expansion plans. With the infusion of capital and expertise from venture capitalists, startups can confidently pursue aggressive growth strategies, refine their business models, and establish themselves as significant players in their industry.

3. Series B Funding

Series B funding is a critical juncture for startups that have successfully navigated their early stages and are now poised for further expansion. This funding round is all about taking a proven business model and amplifying it to capture a larger market share and solidify the startup’s position in the industry.

In Series B funding, startups often attract a mix of venture capitalists, private equity firms, and institutional investors. These investors recognize the startup’s growth potential and want to play a part in its journey to become a market leader.

Becoming Eligible for Series B Funding

To qualify for Series B funding, startups need to demonstrate:

- Sustained Growth: A track record of consistent and impressive growth metrics over an extended period.

- Scalability: Proof that the startup’s business model and operations can scale efficiently without compromising quality.

- Market Dominance: A clear path to becoming a dominant player in the target market.

- Strong Leadership: A capable and adaptable leadership team that can manage the complexities of growth.

Series B funding rounds typically involve even larger investments than Series A. Funding amounts can range from tens of millions to over a hundred million dollars. Startups use these funds to:

- Accelerate customer acquisition

- Develop new products or features

- Invest in technology and infrastructure

- Expand into new geographical markets

- Enhance their team with top-tier talent

Numerous successful startups have leveraged Series B funding to achieve remarkable growth. Companies like Airbnb, Dropbox, and Slack used Series B investments to refine their offerings, expand internationally, and solidify their positions in their respective industries.

4. Series C and Beyond

As startups progress along their growth trajectory, they may enter into subsequent funding rounds beyond Series B. Series C, D, and even later rounds represent a continued commitment to growth, innovation, and market dominance.

Involvement of VCs and Institutional Investors

In later funding rounds, venture capitalists and institutional investors remain crucial partners for startups seeking substantial investments. These investors recognize the potential for mature startups to further expand their operations and solidify their market position.

In later funding rounds, startups are expected to provide a comprehensive overview of their track record. This includes demonstrating consistent growth metrics, proven strategies for customer retention and acquisition, and a clear understanding of their industry’s dynamics.

Later-stage funding rounds often involve significantly larger investments as startups continue to scale. However, this can lead to increased dilution for early-stage investors and founders as new investors enter the scene.

Balancing equity ownership

Startups must strike a balance between securing the capital needed for expansion and maintaining an acceptable level of equity ownership. Negotiating favorable terms becomes crucial, as the valuation of a mature startup can significantly impact its future growth prospects.

5. Strategic Partnerships and Acquisitions

While traditional funding rounds are common, startups have alternative routes to secure resources and funding. Strategic partnerships and acquisitions offer unique avenues for growth and expansion.

Strategic partnerships involve collaborations between startups and established companies that have complementary goals. These partnerships can provide startups with access to capital, distribution networks, expertise, and customer bases that accelerate their growth.

Acquisition occurs when a larger company purchases a startup. This can provide startups with immediate funding, resources, and access to a broader customer base. However, acquisitions often come with the challenge of integrating cultures and maintaining the startup’s innovative spirit.

Pros of strategic partnerships and acquisitions

- Immediate Impact: Partnerships and acquisitions can yield immediate benefits, such as funding and access to resources.

- Market Access: Partnerships offer access to established markets, while acquisitions can expand a startup’s market reach.

Cons of strategic partnerships and acquisitions

- Loss of Independence: Partnerships and acquisitions can result in a loss of autonomy for the startup.

- Integration Challenges: Merging cultures and processes can be challenging after an acquisition.

- Strategic Fit: Not all partnerships and acquisitions align with a startup’s long-term goals.

Strategic partnerships and acquisitions offer startups alternative paths to growth and funding. These approaches can be particularly valuable when startups seek rapid market access, additional resources, or the backing of established industry players. However, they require careful consideration and alignment with a startup’s overall strategy.

6. Bootstrapping and Self-Funding

Bootstrapping refers to the practice of funding a startup using personal savings, revenue generated by the business, or minimal external funding. Bootstrapped startups prioritize self-sufficiency and sustainable growth, aiming to avoid the need for significant outside investment.

Advantages of Bootstrapping

- Autonomy: Founders retain full control over the direction and decisions of the startup.

- Lean Operations: Bootstrapped startups often emphasize efficiency and cost-effectiveness.

- Focused Growth: Limited resources force startups to focus on generating revenue and providing value to customers.

Challenges of Bootstrapping

- Slower Growth: Without external funding, growth can be slower compared to funded counterparts.

- Limited Resources: Bootstrapped startups may face constraints when it comes to hiring, marketing, and scaling.

- Risk of Burnout: Founders might take on multiple roles, leading to potential burnout.

Startups might choose bootstrapping when:

- Proven Business Model: A startup with a clear revenue model can sustain itself without outside funding.

- Niche Markets: Serving a specific, loyal customer base can generate steady revenue.

- High Margin Products/Services: A business with high-profit margins can reinvest earnings for growth.

Bootstrapped startups that achieve consistent growth and profitability can become attractive investment opportunities for later-stage investors. Their proven track record and strong financials demonstrate their ability to execute and adapt.

Bootstrapping is a viable option for startups that prioritize independence and controlled growth. While it may involve slower scaling, bootstrapped startups can achieve stability and profitability on their own terms. Even bootstrapped startups can consider seeking external investment when the time is right to accelerate growth further.

Final thoughts

In the dynamic arena of startups, grasping the concept of “Types of Startup Funding Rounds” is a compass for entrepreneurs. It guides them through the funding landscape, helping them secure resources, foster growth, and thrive in their chosen market. By recognizing each stage’s unique benefits, startups can chart a course toward prosperity and sustainable success.