What is a Single Purpose Entity?, the concept of a Single Purpose Entity, or SPE, has gained significant prominence. In the world of commercial real estate transactions, a single purpose entity (SPE) plays a crucial role. Let’s delve into what exactly an SPE is and why it holds significant importance.

Understanding the concept of a SPE

SPE, which stands for single purpose entity, refers to a legal structure that is typically a limited liability company (LLC) or corporation. Its sole purpose is to hold the title to a specific piece of commercial real estate. Unlike its more expansive counterpart, the special-purpose entity (SPE), an SPE has no other assets or liabilities.

Protecting lenders and owners

Lenders often require borrowers to establish an SPE when seeking a loan to purchase commercial real estate.

The primary reason for this requirement is to protect the interests of both the lender and the owners involved in the transaction.

By holding the property within an SPE, the lender’s collateral—the mortgaged property—is shielded from claims made by other creditors. This insulation ensures that unrelated claims seeking recovery from the property do not pose a threat to the lender or the owners.

Role of a SPE in real estate transactions

In a commercial real estate transaction, an SPE serves as a dedicated entity solely focused on owning and operating the specific property in question.

In some cases, the SPE may enter into contracts with another company owned by the same individuals.

This second company takes charge of property management, tenant leases, and day-to-day business operations.

Alternatively, the SPE may hire a third-party management company to handle these responsibilities.

This setup ensures that all liabilities associated with managing the commercial real estate are confined within the boundaries of the SPE, providing further protection for the lender’s collateral.

Safeguarding against bankruptcy challenges

Another critical aspect of an SPE lies in its special circumstances during bankruptcy proceedings.

As the entity only has one creditor—the lender—the bankruptcy process becomes more straightforward.

In the event of bankruptcy, the lender possesses the sole voting power for crucial bankruptcy decisions, such as approving the SPE’s reorganization plan under Chapter 11.

This prevents other creditors from exerting undue influence and allows the lender to protect their interests effectively.

Bankruptcy remoteness and independent managers

In some cases, lenders may go a step further and require the SPE to be “bankruptcy remote.”

This means that the SPE must obtain the affirmative approval of an independent manager or director before filing for bankruptcy.

This condition ensures that the entity’s integrity remains intact and separate from the owners.

However, for SPEs managed by only a few owners, finding an independent manager can pose challenges due to the requirement of maintaining objectivity.

Qualifying as an SPE

To be legally recognized as an SPE, certain elements must be present.

The most fundamental requirement is a well-crafted purpose clause explicitly stating that the entity exists solely for the ownership and operation of the specific commercial property. This purpose clause is ideally included in the entity formation documents filed with the secretary of state’s office.

Alternatively, it can be documented in the loan agreement between the lender and the borrower.

Lenders may also impose additional covenants to enhance the separation between the SPE and other entities or affiliates.

These covenants may include restrictions on asset co-mingling, prohibiting obligations guaranteeing, maintaining separate tax identification numbers, and dedicated bank accounts.

Depending on the lender’s preferences, restrictions on incurring additional debt or voluntarily seeking bankruptcy protection may also be imposed. While there is no exact set of uniform criteria for SPE qualification, these elements contribute to the recognition of an entity as an SPE.

Balancing Compliance and Benefits

It is worth noting that complying with SPE requirements can come with certain costs.

The obligations placed on the entity and its owners, such as securing an independent manager for bankruptcy remoteness, can become financially burdensome.

However, it is crucial to find the right balance between the lender’s need for protection and the borrowing entity’s willingness to comply. The decision to establish an SPE depends on the specific circumstances and size of the transaction.

Sophisticated business people often recognize the benefits of SPE structuring and willingly undertake the necessary steps to ensure the desired financing while safeguarding their assets and liabilities.

While there may be challenges and costs involved, the potential advantages of protecting the lender’s collateral and mitigating risks make the establishment of an SPE a prudent choice in many commercial real estate transactions.

Requirements to Become a Single Purpose LLC

To establish a single purpose LLC and ensure its legal recognition as an entity dedicated to owning and operating a specific commercial property, certain requirements must be met. These requirements aim to provide clarity and protection for both the LLC and its stakeholders.

Key requirements include:

Purpose Clause:

- Clearly state the purpose of the single purpose LLC.

- Include the purpose clause in a public document filed with the office of the Secretary of State or as part of the loan documents, such as the loan agreement.

- Define restrictions on the LLC’s activities to align with its single purpose designation.

Covenants:

- Maintain separation between the single purpose LLC and other affiliated entities.

- Prohibit comingling of assets to ensure distinct ownership.

- Prohibit guaranteeing obligations of other entities to protect against liabilities.

- Require the single purpose LLC to maintain a separate tax identification number.

- Establish a dedicated bank account to ensure financial independence.

- It is important to note that the specific requirements for a single purpose LLC may vary depending on the lender and the nature of the commercial transaction. Therefore, careful consideration should be given to these factors to ensure compliance and mitigate potential risks.

Benefits and Recommendations:

- Lenders: It is advisable for lenders providing financing to insist on the conversion of the business entity owning the property into a single purpose LLC. This ensures better protection for their collateral and mitigates risks associated with other creditors.

- Business Owners: Business owners often recognize the benefits and protection that come with single purpose LLC structuring. By adhering to the necessary requirements, they can safeguard their assets and liabilities, demonstrating a proactive approach to risk management.

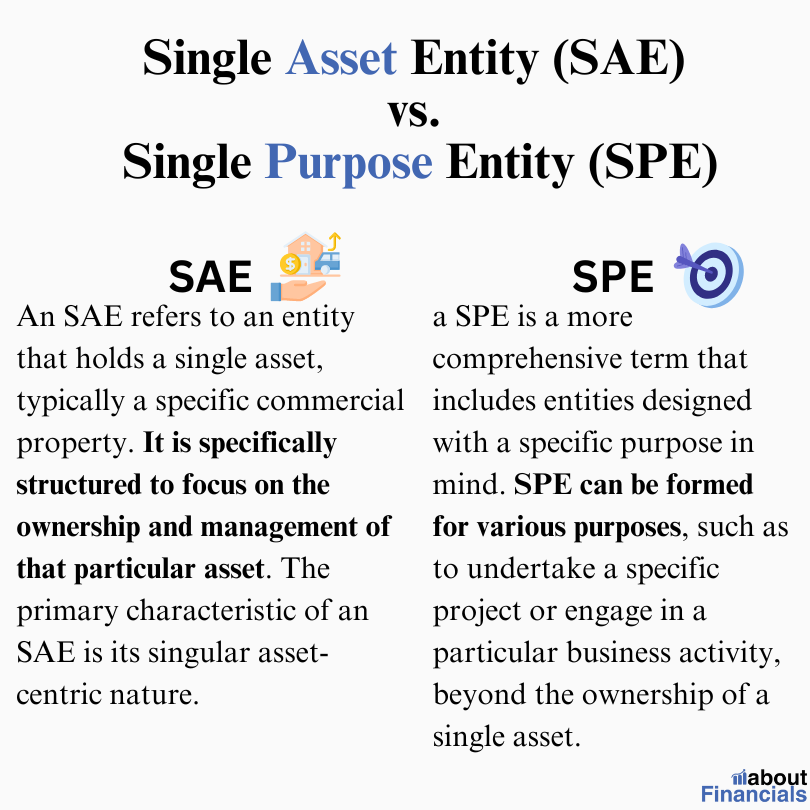

What is the difference between single asset entity and single purpose entity?

A Single Purpose Entity (SPE) is a broader term that encompasses Single Asset Entities (SAEs). The key point to note is that while an SAE will almost always be an SPE, the reverse is not always true.

An SAE refers to an entity that holds a single asset, typically a specific commercial property. It is specifically structured to focus on the ownership and management of that particular asset. The primary characteristic of an SAE is its singular asset-centric nature.

On the other hand, a SPE is a more comprehensive term that includes entities designed with a specific purpose in mind. While it can encompass SAEs, it is not limited to them. SPE can be formed for various purposes, such as to undertake a specific project or engage in a particular business activity, beyond the ownership of a single asset.

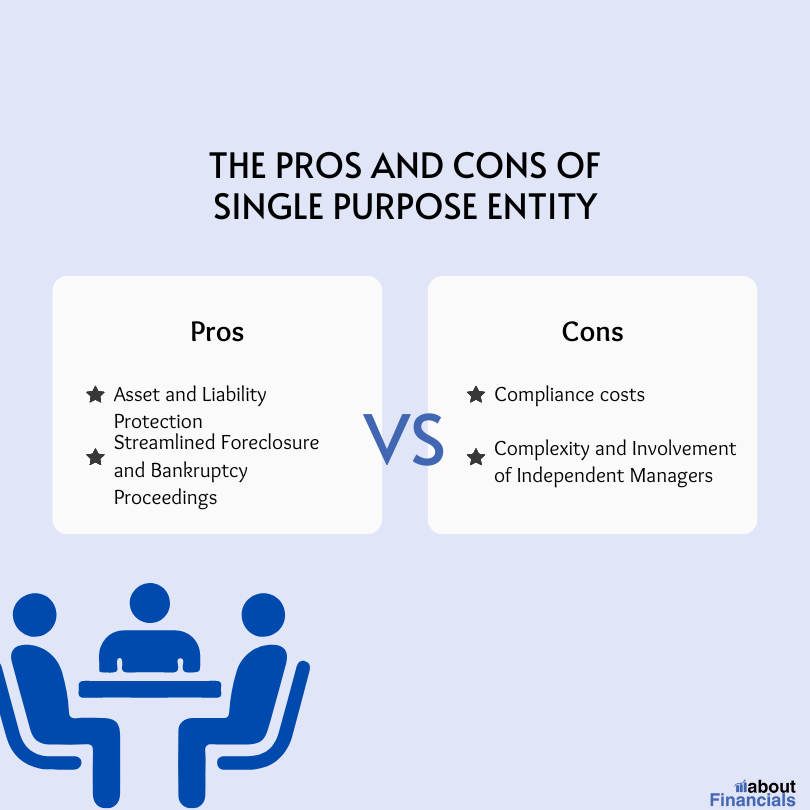

Benefits of Single Purpose Entities

When it comes to commercial transactions, Single Purpose Entities (SPEs) offer a range of advantages for both lenders and borrowers. Let’s explore some of the key benefits that make SPEs an appealing choice:

Asset and Liability Protection – One of the primary benefits of utilizing an SPE is the level of asset and liability protection it provides. For lenders, this means that the collateral tied to a specific transaction is shielded from the risks associated with the borrower’s other assets. Similarly, borrowers can safeguard their personal assets from being entangled in the liabilities of the SPE. This separation offers peace of mind and helps mitigate potential financial risks.

Streamlined Foreclosure and Bankruptcy Proceedings – Inthe unfortunate event of default or bankruptcy, SPEs offer a streamlined process for lenders to foreclose on the collateral or pursue legal remedies. Since the SPE is a distinct legal entity with a dedicated purpose, the foreclosure or bankruptcy proceedings are often more efficient and straightforward compared to general-purpose entities. This can save significant time and resources for all parties involved.

Disadvantages of Single Purpose Entities

While Single Purpose Entities come with notable benefits, it’s important to be aware of the potential challenges that may arise. Let’s delve into some of the key considerations:

Burdens and Costs – compliance with legal and regulatory requirements, such as filing specific documents and meeting ongoing obligations, can be time-consuming and may require professional assistance. Additionally, there might be expenses associated with incorporating and maintaining the entity, such as annual fees and taxes.

Complexity and Involvement of Independent Managers – depending on the nature and scale of the transaction, establishing and operating an SPE can involve the engagement of independent managers. These managers play a critical role in ensuring the separation and independence of the entity from other affiliates or entities. However, their involvement adds complexity to the process, as they need to navigate the legal and regulatory landscape effectively. The costs associated with hiring independent managers should also be considered when evaluating the feasibility of utilizing an SPE.

Final words

SPEs play a significant role in commercial real estate transactions, providing numerous benefits and presenting certain challenges. For lenders and borrowers, SPEs offer asset and liability protection, safeguarding the collateral and personal assets from potential risks.

However, it is essential to consider the challenges that come with SPEs. Compliance with legal and regulatory requirements can be burdensome, requiring time and professional assistance.

It is important to consult legal and financial professionals to ensure compliance with applicable laws and regulations and to obtain tailored advice based on the specific transaction and jurisdiction. By doing so, stakeholders can navigate the intricacies of SPEs effectively and make informed decisions to enhance the security and success of their commercial endeavors.