Financial statements are the backbone of any business’s financial reporting. They provide a snapshot of a company’s financial position, performance, and cash flow over a specific period. In simpler terms, financial statements are like a company’s financial report card, revealing its financial health and stability.

Importance of financial statements for small business owners

As a small business owner, understanding and utilizing financial statements is crucial for several reasons.

Here’s why these statements hold immense significance for your business:

Insight into financial health

Financial statements offer valuable insights into your business’s financial health. By analyzing these statements, you can assess your company’s profitability, liquidity, and solvency.

Performance evaluation

Financial statements serve as a yardstick to evaluate your business’s performance over time. By comparing financial statements from different periods, you can track your progress, identify trends, and spot areas that need improvement.

Decision making

Whether you’re considering expanding your business, investing in new equipment, or seeking funding from investors or lenders, financial statements help you assess the financial feasibility and potential risks involved.

Building credibility

Small businesses often need to establish credibility and trust with various stakeholders, including investors, lenders, and partners. Financial statements demonstrate your business’s transparency and financial stability which eventually help in securing the necessary funding or partnerships.

Compliance and legal obligations

Financial statements form the basis for accurate tax reporting, ensuring that you fulfill your tax obligations and avoid penalties. Additionally, financial statements facilitate audits and financial reviews, ensuring transparency and accountability.

Types of Financial Statements

1. Balance Sheet

Think of the balance sheet as a financial snapshot of your business at a specific point in time.

It provides a clear overview of your company’s financial position, showing what it owns (assets), what it owes (liabilities), and the residual value for the owners (equity).

The balance sheet helps you understand the financial stability and net worth of your business.

Components: Assets, Liabilities, Equity

Assets

Assets are the resources and properties that your business owns, which have economic value and can be used to generate future benefits. Tangible assets are physical items that can be seen or touched. Examples of tangible assets include cash, inventory (goods held for sale), equipment, vehicles, and real estate. These assets are essential for the day-to-day operations of your business and contribute to its overall value.

Intangible assets, on the other hand, are non-physical assets that hold value but cannot be physically touched. They include intellectual property such as patents, trademarks, copyrights, and brand recognition. Intangible assets play a significant role in distinguishing your business from competitors and can contribute to long-term profitability and market advantage.

Liabilities

Liabilities, on the other hand, represent the financial obligations and debts that your business owes to external parties. This can include loans from banks or financial institutions, accounts payable to suppliers or vendors for goods or services received, or accrued expenses such as unpaid salaries or taxes. Liabilities reflect the claims that creditors or other stakeholders have on your business’s assets.

Equity

Lastly, equity represents the residual interest in your business after deducting liabilities from assets. It is the ownership interest in the business and can be expressed as shareholders’ equity for corporations or owner’s equity for sole proprietorships or partnerships. Equity represents the portion of the business’s value that belongs to the owners or shareholders.

You can explore the balance sheet of Berkshire Hathaway to analyze the different components of balance sheet. It will give you good insight on how these components are linked with each other.

2. Income statement

The income statement, also known as the profit and loss statement or P&L statement, provides a summary of your business’s revenues, expenses, and overall profitability over a specific period.

The purpose of the income statement is to measure the ability of your business to generate revenue, control expenses, and ultimately determine its net income.

Components of income statement

- Revenue: Revenue represents the total income generated by your business from its core operations.

- Expenses: Expenses encompass the costs incurred to operate your business and generate revenue. They can be categorized into various types, including the cost of goods sold (COGS), employee salaries and benefits, rent, utilities, marketing and advertising expenses, and administrative costs.

- Net Income: Net income, also referred to as the bottom line or profit, is the amount that remains after subtracting expenses from revenue. It represents the profit earned by your business during the specified period.

Just for your quick reference, we would recommend reviewing income statement of GE to build solid understanding of the financial statements.

3. Cash flow statement

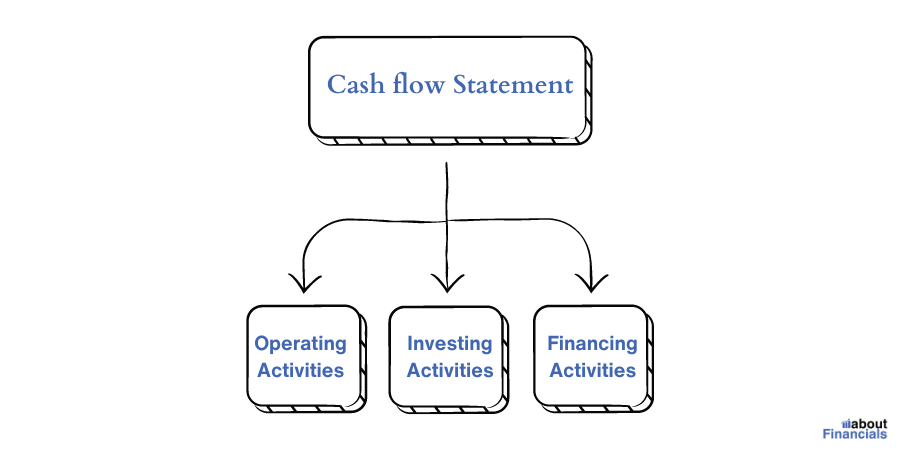

The cash flow statement is a financial statement that provides insights into the cash inflows and outflows of a business during a specific period.

The purpose of the cash flow statement is to provide a clear picture of your business’s liquidity, showing where cash is coming from and how it is being spent.

It helps you assess the ability of your business to generate cash, meet its financial obligations, and identify potential cash flow issues that may impact your operations.

Components of cash flow statement

- Operating Activities: This component focuses on the cash flow resulting from your primary business operations. It includes cash receipts from sales of goods or services and cash payments for expenses such as salaries, rent, utilities, and inventory. Operating activities reflect the day-to-day cash flow directly related to your business’s core operations.

- Investing Activities: Investing activities involve cash flows related to the purchase or sale of long-term assets and investments. This can include cash inflows from the sale of property, plant, and equipment or investments, as well as cash outflows from the acquisition of new assets or investments. Investing activities demonstrate how your business allocates cash for future growth and capital expenditures.

- Financing Activities: Financing activities encompass cash flows associated with raising capital and repaying debts. This includes cash inflows from obtaining loans, issuing stock, or securing investments from shareholders. On the other hand, cash outflows can occur when repaying loans, buying back shares, or distributing dividends to shareholders. Financing activities provide insights into how your business obtains and utilizes external funding.

4. Statement of changes in equity

This statement narrates the journey of equity over a specific period, capturing the impact of various transactions on shareholders’ interests.

It harmonizes contributions, profits, losses, dividends, and other changes, guiding us through the company’s equity composition and transformation.

5. Notes to the accounts

The notes to the accounts provide the insightful annotations to our financial composition.

These accompanying notes offer valuable explanations, clarifications, and additional disclosures. They enrich our understanding of the numbers, unraveling the story behind the financial statements. From accounting policies to contingencies, these notes add depth and context to the financial information.

6. Statement of retained earnings

The statement of retained earnings is a financial statement that is primarily relevant to companies with shareholders or stockholders. It tracks the changes in retained earnings over a specific period, reflecting the portion of net income retained within the company rather than distributed as dividends.

It showcases how much of the net income generated is reinvested back into the business to support growth and how much is distributed to shareholders in the form of dividends.

Components

- Net Income: Net income represents the profit earned by the company during a particular period after deducting all expenses, taxes, and interest. It is a crucial component of the statement of retained earnings as it directly impacts the calculation of retained earnings. Higher net income implies more funds available for distribution as dividends or reinvestment.

- Dividends: Dividends are the payments made to shareholders as a share of the company’s profits. They represent the portion of earnings distributed to shareholders as a reward for their investment. Dividends can be in the form of cash or additional shares of stock. The statement of retained earnings captures the dividends paid out during the period under review.

- Retained Earnings: Retained earnings represent the cumulative profits retained within the company since its inception. It reflects the portion of net income that has not been distributed as dividends but rather reinvested back into the business. Retained earnings contribute to the company’s equity and can be used for future expansion, research and development, debt repayment, or other business initiatives.

The statement of retained earnings allows shareholders and stakeholders to understand how profits are allocated within the company. It demonstrates the commitment to reinvesting in the business’s growth potential and provides insights into the company’s financial stability and long-term prospects.

Objectives of financial statements

The objectives of financial statements go beyond mere numbers and figures.

They serve as powerful tools that provide valuable insights into a company’s financial performance, position, and cash flows.

Let’s explore the key objectives of financial statements:

- Providing Information: The primary objective of financial statements is to provide relevant, accurate, and timely information about a company’s financial activities. This information helps stakeholders, including owners, investors, lenders, and suppliers, make informed decisions regarding their involvement with the company.

- Assessing Financial Performance: Financial statements enable stakeholders to assess a company’s profitability, revenue growth, and overall financial performance. They provide an overview of the company’s revenues, expenses, and net income, allowing stakeholders to evaluate its efficiency, productivity, and ability to generate profits.

- Evaluating Financial Position: Financial statements, particularly the balance sheet, offer a snapshot of a company’s financial position at a specific point in time. They highlight the company’s assets, liabilities, and shareholders’ equity, enabling stakeholders to assess its liquidity, solvency, and financial stability.

- Facilitating Comparisons: Financial statements allow stakeholders to compare a company’s performance and position over different periods, enabling them to identify trends, patterns, and areas of improvement. These comparisons help in assessing the company’s growth trajectory, identifying strengths and weaknesses, and making strategic decisions.

- Supporting Decision-Making: Financial statements assist stakeholders in making crucial business decisions. Whether it’s evaluating investment opportunities, assessing creditworthiness, or determining pricing strategies, financial statements provide the necessary financial information to support informed decision-making.

- Ensuring Accountability and Transparency: Financial statements play a vital role in promoting accountability and transparency within a company. They provide a clear record of financial activities, ensuring that management’s actions are visible to stakeholders. This transparency builds trust, enhances credibility, and fosters a positive business environment.

The objectives of financial statements encompass providing relevant information, assessing financial performance and position, facilitating comparisons, supporting decision-making, and ensuring accountability and transparency. By fulfilling these objectives, financial statements empower stakeholders to make informed decisions and contribute to the overall success of the company.

Final thoughts

Financial statements may seems different in nature, but the overall purpose of these are to give true and fair view of the financial information. Financial statements are essential tools for small business owners to understand their financial health, evaluate performance, make informed decisions, and comply with legal obligations.

Understanding these financial statements enables small business owners to gain insights into their financial health, evaluate performance over time, and make informed decisions about growth, investments, and funding. Additionally, financial statements help establish credibility with stakeholders and ensure compliance with legal and regulatory obligations.

By utilizing financial statements effectively, small business owners can strengthen their financial management, improve decision-making, and contribute to the long-term success and sustainability of their businesses.