When it comes to assessing a company’s financial performance and understanding its financial health, three key documents play a crucial role: the income statement, balance sheet, and statement of cash flow.

Each of these financial statements offers unique insights into different aspects of a business’s financial operations. Let’s explore each of them in more detail:

Income Statement

The income statement, also known as the profit and loss statement, focuses on a company’s revenues, expenses, and profitability over a specific period, usually a month, quarter, or year.

It provides a comprehensive overview of the company’s financial performance by showing the net result of its revenue-generating activities after deducting all expenses. The income statement reveals the company’s ability to generate profits, identifies cost structures, and highlights trends in revenue and expenses. It helps stakeholders evaluate the company’s operational efficiency, profitability, and overall financial viability.

Balance Sheet

The balance sheet is a snapshot of a company’s financial position at a specific point in time, usually the end of a reporting period. It presents a summary of the company’s assets, liabilities, and shareholders’ equity.

Assets encompass everything the company owns, including cash, inventory, property, and investments.

Liabilities represent the company’s debts and obligations, such as loans, accounts payable, and accrued expenses.

Shareholders’ equity reflects the ownership interest in the company. The balance sheet provides insights into the company’s financial stability, liquidity, and capital structure. It allows stakeholders to assess the company’s resources, obligations, and overall financial health.

Statement of cash flow

The statement of cash flow focuses on a company’s cash inflows and outflows during a specific period, typically aligning with the income statement and balance sheet.

It categorizes cash flows into three main activities: operating activities, investing activities, and financing activities.

Operating activities include cash flows from the company’s day-to-day operations, such as cash receipts from sales and payments to suppliers.

Investing activities involve cash flows related to the company’s investments in assets or securities, such as the purchase or sale of equipment or investments.

Financing activities encompass cash flows associated with raising capital, repaying debt, or distributing dividends to shareholders. The statement of cash flow provides valuable insights into a company’s cash position, liquidity, and ability to generate and manage cash flows.

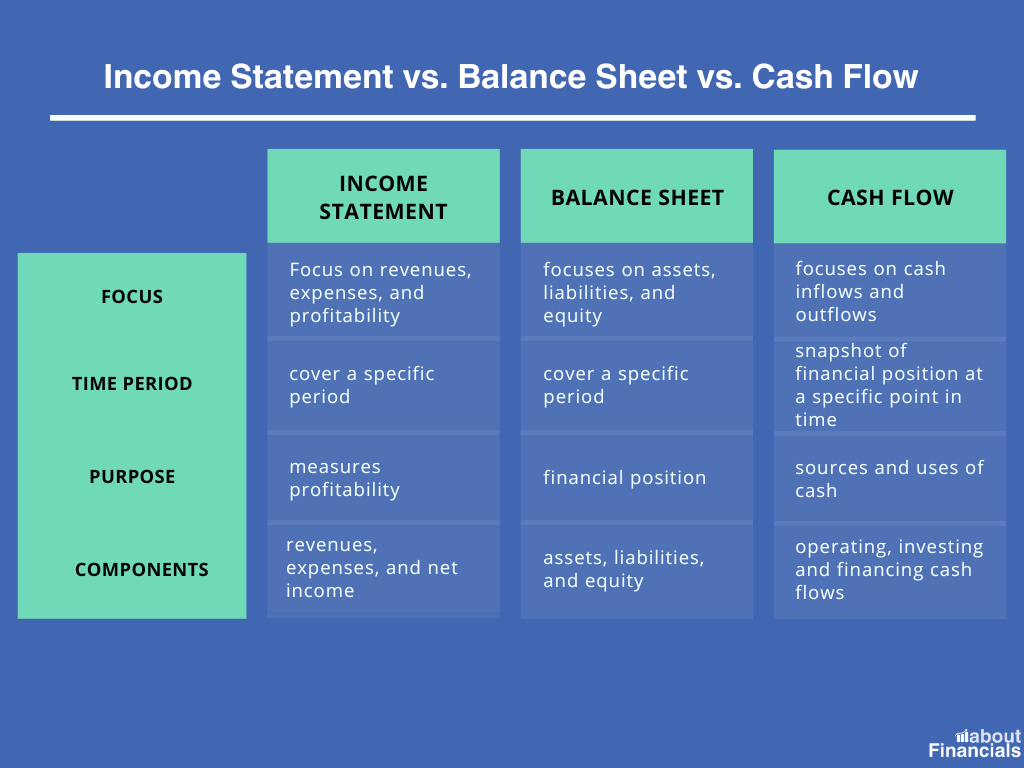

Income Statement vs. Balance Sheet vs. Cash Flow

While the income statement, balance sheet and cash flow statement are essential financial statements, they serve different purposes and provide distinct insights into a company’s financial performance and position. Here’s a breakdown of their differences:

- Focus: The income statement focuses on revenues, expenses, and profitability. The balance sheet focuses on assets, liabilities, and equity. The cash flow statement focuses on cash inflows and outflows.

- Time Period: The income statement and cash flow statement cover a specific period, such as a month, quarter, or year. The balance sheet represents a snapshot of a company’s financial position at a specific point in time.

- Purpose: The income statement measures profitability and the company’s ability to generate income. The balance sheet provides a summary of the company’s financial position. The cash flow statement shows the sources and uses of cash.

- Components: The income statement includes revenues, expenses, and net income. The balance sheet includes assets, liabilities, and equity. The cash flow statement includes operating cash flows, investing cash flows, and financing cash flows.

Simplified comparison of Income statement, Balance sheet and Cash flow

| Description | Income Statement | Balance Sheet | Statement of Cash Flows |

| Purpose | Measure profitability and financial performance | Present financial position at a specific date | Show cash inflows and outflows during a period |

| Timeframe | Covers a specific period | Represents a specific date | Covers a specific period |

| Components | Revenues, expenses, net income (or net loss) | Assets, liabilities, shareholders’ equity | Cash flows from operating, investing, and financing activities |

| Focus | Assess operational performance and profitability | Assess financial position and stability | Show sources and uses of cash |

| Assessment | Revenue growth, profitability, trends | Financial stability, liquidity, solvency | Cash flow generation, cash management |

| Key Insight | Profitability, revenue and expense trends | Financial resources, obligations, ownership structure | Cash flow sources and uses, liquidity management |

Final thoughts

By analyzing these three financial statements together, stakeholders can gain a comprehensive understanding of a company’s financial performance, position, and cash flow management. The income statement highlights profitability, the balance sheet provides a snapshot of financial position, and the statement of cash flow reveals the company’s cash flow dynamics. These documents collectively assist in informed decision-making, financial planning, and evaluating the overall health and sustainability of a business.