In this extensive article, we will not only explore the concept of liabilities but also go deep into their significance, nuances, and practical applications. Whether you are an individual navigating your personal finances or a business owner steering your company’s financial ship, a thorough understanding of liabilities is essential. So, let’s embark on this comprehensive journey into the world of liabilities, aiming for a detailed and insightful exploration.

Definition of a Liability

To kick off our exploration, let’s start with the fundamental definition of a liability. In its essence, a liability represents an existing obligation that arises from past events, binding individuals or entities to transfer economic resources. It is, in simpler terms, the responsibility one has to settle specific commitments. Liabilities can encompass a wide array of obligations, ranging from monetary debts to contractual agreements. Understanding this core definition is crucial as it forms the bedrock upon which all other aspects of liabilities are built.

Understanding the Connection

Liabilities are not merely abstract concepts; they are tangible connections that link individuals and organizations to various stakeholders. Imagine, for a moment, that you owe someone money. In this scenario, you become the debtor, and the money you owe constitutes a liability. This fundamental concept applies universally, spanning both individuals and companies.

For businesses, liabilities extend far beyond personal debts. They encompass obligations to suppliers, creditors, lenders, and a multitude of other parties. These obligations are not trivial; they are integral to the functioning and sustainability of any business entity. To reflect a true and fair view of a company’s financial condition, management must diligently account for and disclose these obligations as liabilities. Doing so is not just a matter of financial compliance; it’s a vital step in fostering trust and transparency with stakeholders.

Types of Liabilities

The world of liabilities is not monolithic; it comprises various categories, each with its distinct characteristics and implications. Broadly speaking, liabilities can be classified into two main types: current and non-current (or long-term) liabilities.

Current Liabilities

Current liabilities are the financial commitments that must be settled within the fiscal year. These obligations are typically short-term in nature and represent the financial responsibilities that a company or individual must address in the immediate future. Examples of current liabilities include accounts payable, interest payable, and taxes due.

Let’s illustrate this with a concrete example: Suppose you take your car to a mechanic, and the mechanic presents you with a $500 invoice for the repairs. The mechanic specifies that you must settle this invoice by March 31, 2022. Until you make the payment, you hold a current liability—the $500 you owe.

Current liabilities are akin to financial “to-do” lists, highlighting the imminent financial obligations that require attention and settlement.

Non-Current Liabilities

In contrast, non-current liabilities are the financial commitments that extend beyond a year. These are long-term obligations that encompass a wide spectrum of financial arrangements. Examples of non-current liabilities include long-term debts, employee benefits, and deferred income tax. These commitments are characterized by their extended payment schedules, often spanning multiple years.

Non-current liabilities reflect the enduring financial responsibilities that individuals and organizations must manage over an extended period. These obligations may not demand immediate action, but they necessitate careful long-term planning to ensure financial stability and sustainability.

Contingent Liabilities

While current and non-current liabilities are explicit and quantifiable, there exists a unique category known as “contingent liabilities.” Contingent liabilities are potential obligations that might materialize in the future due to uncertain events. These liabilities are somewhat elusive and challenging to predict with precision.

Large corporations, in particular, frequently grapple with contingent liabilities. These may include potential financial losses stemming from lawsuits, pending legal cases, or product warranty claims. The uncertainty surrounding these liabilities makes them complex to measure reliably.

The disclosure of contingent liabilities in financial statements is subject to specific criteria and guidelines. Companies must tread carefully, striking a balance between transparency and responsible financial reporting.

Real-Life Example

Let’s illustrate the concept of liabilities with a real-life example. Consider Mike, the owner of a cozy coffee shop. In pursuit of expanding his business, Mike decides to take a $20,000 loan from the bank on January 1, 2022, to purchase state-of-the-art coffee equipment. This loan agreement stipulates that Mike must repay the loan in ten yearly installments of $2,000 each.

Now, let’s dissect the liabilities in this scenario:

- The upcoming payment of $2,000 due in December 2022 qualifies as a current liability. This is because it represents a financial obligation that must be settled within the fiscal year.

- The remaining $18,000, which will be paid in subsequent years, is classified under long-term liabilities on Mike’s balance sheet. These are non-current liabilities, as they extend beyond the current fiscal year.

This example underscores the practical application of differentiating between current and non-current liabilities in financial accounting and reporting. It also emphasizes the importance of meticulous financial planning to meet these obligations effectively.

What is a Liability in a Business

To gain a deeper understanding of how liabilities manifest in the corporate world, let’s explore some common examples of liabilities found on a company’s balance sheet:

Accounts Payable

Accounts payable represent obligations to suppliers for goods or services received. Businesses often purchase raw materials, equipment, or services on credit terms, creating accounts payable. These are considered current liabilities as they are expected to be settled in the near future.

Accrued Liabilities

Accrued liabilities represent services received but not yet invoiced. For instance, if a company receives services from a supplier but has not received an invoice for those services, the estimated amount owed becomes an accrued liability.

Accrued Wages

Accrued wages refer to wages earned by employees but not yet paid by the employer. This is a current liability that reflects the company’s obligation to compensate its workforce.

Advances Received

Advances received are amounts received from customers or clients for goods or services that are yet to be delivered. These are liabilities until the company fulfills its part of the agreement.

Current Portion of Debt Payable

The current portion of debt payable includes the portion of long-term debt that is due for repayment within the current fiscal year. It is classified as a current liability.

Taxes Payable

Taxes payable encompass various tax obligations, such as income tax and sales tax, that a company owes to tax authorities. These are typically current liabilities due for settlement in the current fiscal year.

These examples underscore the diversity of liabilities encountered by businesses in their day-to-day operations. Each liability represents a specific financial commitment that necessitates attention and management.

Liabilities vs. Assets

To appreciate the significance of liabilities fully, it’s essential to understand their relationship with assets—a cornerstone concept in finance. Assets represent what a company owns or controls, with the potential to yield future economic benefits. Liabilities, on the other hand, represent obligations that lead to an outflow of economic benefits.

The interplay between assets and liabilities is crucial in determining an entity’s financial health. The goal is to ensure that the value of assets exceeds the value of liabilities, resulting in a positive net worth or equity. This positive equity signifies that the entity’s assets can cover its obligations, creating a strong financial position.

Liabilities vs. Expenses

Another key distinction worth noting is the difference between liabilities and expenses. While both are vital components of financial accounting, they serve different purposes and are reported on different financial statements.

Liabilities, as we’ve discussed, represent existing obligations to transfer economic resources. They are recorded on the balance sheet, providing a snapshot of the entity’s financial position as of the balance sheet date.

Expenses, on the other hand, represent the costs incurred in the process of generating revenue. Expenses are recognized on the income statement, which reflects the entity’s financial performance over a specific period, typically a fiscal quarter or year.

In summary, liabilities represent the financial commitments that an entity owes, while expenses represent the costs incurred in the pursuit of generating revenue.

Snapshot of a Balance Sheet

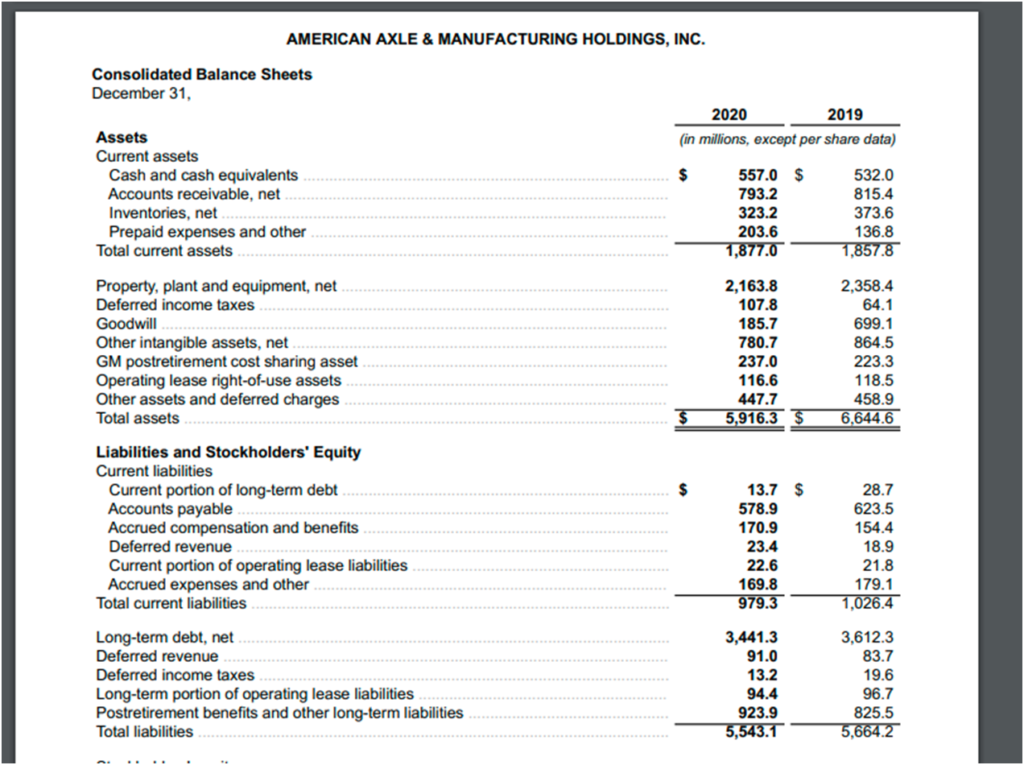

To gain a practical perspective on how liabilities are presented in financial statements, let’s examine a snapshot of a balance sheet. We’ll use the fictitious entity “AAM” for this illustrative example.

Balance Sheet of AAM (As of December 31, 2019)

In this balance sheet for “AAM,” you can observe how current and non-current liabilities are presented alongside assets and equity. This format provides a clear and organized representation of the entity’s financial position, enabling stakeholders to assess its solvency and overall financial health.

Final Thoughts

In conclusion, liabilities are not merely financial buzzwords; they are the foundations upon which financial management and reporting rest. A thorough understanding of liabilities empowers individuals and businesses to make informed decisions about their financial health. By distinguishing between current and long-term liabilities and considering the elusive nature of contingent liabilities, we gain a more comprehensive view of an entity’s financial position.

Liabilities are not static; they evolve with time and transactions. As businesses grow and adapt, their liabilities may change in terms of type, amount, and complexity. Consequently, effective liability management is an ongoing endeavor, requiring diligence and foresight.

For individuals, managing personal liabilities, such as mortgages, loans, and credit card debts, is crucial for achieving financial goals and maintaining financial well-being. Understanding the interplay between assets, liabilities, and equity empowers individuals to make sound financial decisions and build a secure financial future.

In the corporate world, businesses must navigate a complex landscape of financial obligations, from accounts payable to long-term debt. Managing these liabilities effectively is paramount for financial stability and growth. Moreover, transparent reporting of liabilities is essential for building trust and credibility with investors, creditors, and other stakeholders.

In the ever-evolving world of finance, a nuanced understanding of liabilities is not just a valuable asset; it’s a strategic imperative. It equips individuals and organizations alike to navigate the complexities of the financial landscape and make informed decisions that shape their financial destinies. So, whether you are balancing your personal budget or managing a multinational corporation, the depth of your understanding of liabilities will determine your financial course and destination.